Category: Merge Blog

Before You Sign: Unmasking Contractor Scams

May 23, 2025Author: Clark Fennimore

Homeowners insurance is an important investment in the interest of keeping a home in good condition. Its importance has to do with many unforeseen circumstances in which professional work needs to be done on the structure of a house. One such circumstance comes from significant weather conditions that may damage the exterior and interior of a home. When such a type of weather hits an area, many homeowners in that area use their insurance to cover the needed repairs.

Consequently, there are ways that this scenario can lead to fraud, possibly at the hands of the contractor doing the work. The contractor, in such a case, often makes some type of unexpected offer to homeowners in the area about fixing their homes. Some even have a practice of looking for an area where some weather event is occurring so that they can solicit business from its residents for this purpose. They will notify the homeowner that they’ve located an area of the residence in need of repair, and convince them to file a claim with their insurance companies. However, these contractors will often create the damage themselves while the homeowner is distracted or otherwise unaware. Many of these false claims occur while a contractor is on the roof of a home. Homeowners can also commit fraud in a similar scenario, but by lying about details concerning the claim. With weather conditions as a significant type of circumstance for insurance claims, approximately 10% of claims involve fraud.

There are ways to make sure that work on one’s home is performed honestly. The initial step is contact with one’s insurer as a source of information before a contactor is even consulted. After that, a contractor is to be selected based on professional standards, such as if they have a license; consulting more than one before choosing is a good idea. Other important steps while making contact with the selected contractor include an official contract and continual awareness of the work being done. These methods give the homeowner knowledge to spot potential fraud, leading to the step of legal consultation and the involvement of a trusted investigation company if necessary.

Sources:

https://helpstopfraud.org/wp-content/uploads/2022/02/Homeowners-Guide.pdf

https://www.insurancebusinessmag.com/us/news/property/nicb-enlists-20-states-in-battle-against-contractor-fraud-490266.aspx

Artificial Intelligence In Claims: Friend, Foe, or Both?

April 24, 2025Contributing authors: Olivia Maxwell, Emily Epps, Clark Fennimore

AI (Artificial Intelligence) has been taking the world by storm over the last few years, improving efficiency, assisting in a variety of functions, and overall becoming a useful time-saving tool for a wide range of professions. Despite all the benefits that come with AI, there are, unfortunately, people who have been utilizing this super-tool for evil.

This is why we can’t have nice things.

Although still in its relatively early stages, AI already seems like it has limitless capabilities. Things such as image generation, deepfake videos, voice cloning, and the beloved ChatGPT, along with other LLMs (Large Language Models), are just a few tools AI has to offer. AI is in continuous development and improves its efficacy each day.

With its constant improvement, it is becoming harder to determine when something has been produced or altered with AI. While this would normally be a good thing, it means that it is also becoming more difficult for claims professionals to detect when AI has been used to manipulate insurance claims. Image generative artificial intelligence software, which produces high-quality visuals based on a prompt entered by the user, could be used to create false “evidence” of property damage, visible injuries that may not truly exist, and even fake x-rays and other medical records. Fraudsters can use voice cloning to impersonate a witness giving a statement, or mimic someone who is no longer living in order to collect social security and other benefits on their behalf. Deepfake technology, which can create artificial photographs or video footage, can also be used to impersonate witnesses, as well as to provide false documentation or obtain access to protected information. Lastly, LLMs can be used to create phony medical records, false police reports, other fake legal documents, and bogus billing statements or receipts.

As a claims professional, you may be reading this and thinking you now have to become some sort of super-human AI detector. This isn’t true at all. There are AI systems that focus solely on identifying the manipulation of images and documents that have been submitted as evidence, as well as detecting if an image has been copied from somewhere else on the internet. This technology can also sense when metadata has been tampered with; this surprisingly big industry (now paying people to alter metadata on photos) is the reason why even the FBI has issued a warning about criminals and fraudsters using generative AI).

Although AI can save time during the claims review process by scanning documents and statements to expose potential dishonesty and inconsistencies through behavioral analysis, and it can alert you when further investigation may be warranted, fraudsters can use AI to gain the upper hand. In fact, certain AI systems can even analyze body language, expressions, and speech in recorded media to identify dishonesty and assess credibility.

AI is reshaping the insurance industry as we know it, by analyzing large volumes of data and improving companies’ efficiency. However, that doesn’t take away from AI’s bias, which can lead to unfair outcomes, since certain AI algorithms can sometimes over-exaggerate pre-existing bias. This issue has led companies to question how ethical AI is and whether new ethical guidelines need to be put in place for these algorithms.

However, this isn’t a battle of humans versus AI, because we have the ability to use AI ourselves to detect others’ use of AI (this really could be the start of a great idea for a new movie series). By fighting fire with fire, we can use AI to deter fraudsters and gain the upper hand.

It is our responsibility to keep ourselves educated as AI technology progresses so that we may remain hypervigilant in the fight against insurance fraudsters. By familiarizing ourselves with these emerging fraud trends, and adapting our own strategies in response, we can view AI technology as an advantage instead of a threat.

Sources:

Workers’ Compensation: The Origin Story

May 31, 2024Author: Liz Maurer

A brief history of Workers’ Compensation

In the insurance industry, workers’ compensation claims can seem difficult to navigate. But the history and evolution of, what we call, workers’ compensation can offer a new perspective on how and why these systems became what they are today. The concept of compensation for bodily injury began thousands of years ago, shortly after the advent of written history itself.

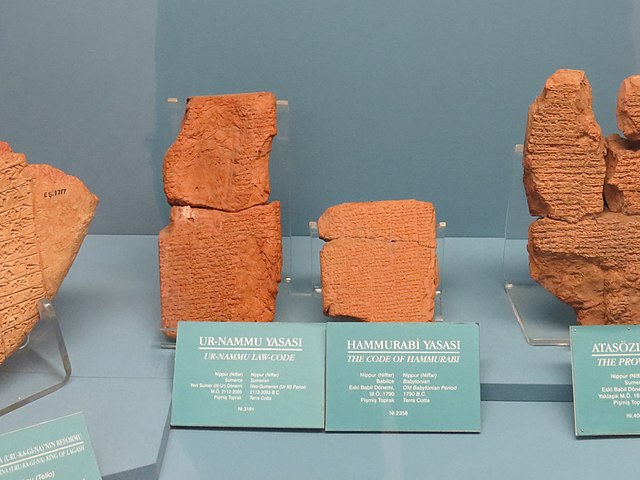

2100-2050 B.C.E. Ur Nammu

King Ur-Nammu, the ruler of the ancient Sumerian city of Ur, created the Code of Ur-Nammu, which was written on tablets and was comprised of 40 paragraphs containing both civil and criminal offenses, along with their punishments. Among other things like defining class rank and outlining the consequences of witchcraft, the Code of Ur-Nammu provided the first legal system in which monetary compensation was paid to injured victims. Much like modern day insurance, the amounts to be paid were based on the anatomic location of the injury as well as the severity.

This compensation system was also to be provided to laborers that were injured while performing their duties, making this the first documented instance of workers’ compensation in history. Heavy machinery and construction equipment didn’t exist in ancient times, so many workers’ injuries were caused directly by other people (and not always accidentally), so it was the offender’s personal responsibility to compensate the victim. The Code of Ur-Nammu became the basis for countless other legal codes and formed the foundation of legal systems still in place today.

The first copy of the Code of Ur-Nammu is currently on display at the Istanbul Archeological Museum.

1795-1750 B.C.E. Hammurabi

King Hammurabi of the Old Babylonian Empire brought us the Code of Hammurabi, famously known for its unforgiving tit-for-tat, or eye for an eye disbursement of justice. The focus was on physically punishing perpetrators rather than just compensating the victim. And while the punishments certainly seem harsh by modern standards, the Code of Hammurabi sought to protect workers from employers whose negligence caused them harm.

The Code of Hammurabi was one of the earliest examples of the concept of presumption of innocence and gave both the accused and the accuser the opportunity to provide evidence. If it could be proven that a worker was injured unintentionally, and not due to their employer’s neglect or carelessness, the employer was only on the hook for the victim’s medical costs, and they could keep all their limbs.

Workers’ Compensation laws continued to evolve in the coming years as ancient Greek, Roman, Arab and Chinese civilizations soon adopted their own sets of compensation schedules. However, all these very early schedules of compensatory rates were either overly specific or vague, leaving way too much room for interpretation in either direction.

The term “eye for an eye” comes from the Code of Hammurabi: “If a man has destroyed the eye of a man of the gentleman class, they shall destroy his eye.”

500s-1400s

These ancient compensation schedules were gradually replaced during the Middle Ages as feudalism became the primary structure of government. It was now up to feudal lords to make the determination about what, if any, injuries garnered compensation. Sometimes this worked in the victim’s favor, as it was an act of nobility and honor for a lord to care for an injured serf, but this was not always the case as not all feudal lords were so noble when nobody was watching.

1400s-1800s

The development of English common law in the late Middle Ages and Renaissance era gave rise to a new legal framework that persisted into the early Industrial Revolution across America and Europe. In response to the increasing number of free citizens entering the workforce doing more labor-intensive jobs, early English Common Law established three principals upon which it would be determined if an injury was compensable. But these principals were known to be so incredibly restrictive, that they became known as the “unholy trinity of defenses.”

- Contributory Negligence- if a worker was in anyway responsible for their injury, the employer would not be held liable, regardless of how hazardous the machinery or equipment may have been

- The “Fellow Servant” rule- employers were exempt from liability if a workers’ injuries arose out of the negligence of a co-worker

- The “Assumption of Risk”- employees are made aware of the potential hazards of any job once they sign their employment contracts, and they accept those risks. Because the risks were so high, these employment contracts became appropriately known as “Death Contracts”

Meanwhile in Prussia, Chancellor Otto Von Bismark established the Employers’ Liability Law of 1871.

The law provided social protection to workers who held high risk positions in factories, quarries, railroads, and mines. Several years later after the unification of Germany, Bismarck also created Workers’ Accident Insurance, the first modern system of workers’ compensation. These state-administered systems reserved large monetary benefits for job-related injuries, and covered both medical care and rehabilitation for injured workers.

Otto Von Bismarck was known for wearing a military uniform anytime he faced the public, even though he never actually served in the military.

The British eventually followed suit in 1893 with the proposal of the Workers Compensation Act, which would abolish the unholy trinity of defenses, including the issuance of “death contracts.” The Act held that an employee was entitled to compensation for any accident that was not their fault, even if there was no negligence on the part of the employer. Unlike the German model, the Act did not rely on the state to administer compensation, but it was instead up to organizations called “friendly societies,” which were mutual financial institutions similar to modern day insurance companies.

1900s- Present Day

The United States was slower to adopt the hot new trend of compensating workers for occupational injuries, giving rise to social movements like the “Muckrakers,” which was a group of authors who wrote about the struggles of working in the modern industrial society. The most famous among these was Upton Sinclair, who published The Jungle in 1906. His novel exposed the horrific conditions in Chicago slaughterhouses from an immigrant workers’ perspective in graphic detail and in no uncertain terms.

Upton Sinclair in 1900

In response to the growing unrest, Congress passed the Federal Employers’ Liability Act of 1908 under President Howard Taft which amended the unholy trinity of defenses to be less restrictive and more in favor of the worker. Keeping in mind this reform came at the federal level, it was still up to individual states to establish their own workers’ compensation guidelines.

In 1910, representatives of the industrial states assembled for a conference in Chicago with the goal of creating a unified set of guidelines for workers’ compensation law.

The first set of comprehensive workers’ compensation laws at the state level was passed in Wisconsin in 1911. Nine other states quickly passed similar legislation, followed by another 36 states before the end of the decade. Mississippi, the final state to pass workers’ compensation laws, finally did so in 1948.

In their original form, most state compensation acts made employer participation optional. But because employers who declined to participate were barred from using those common-law, unholy trinity defenses, the vast majority of employers opted in.

Today, after several thousand years of history in the making, our workers’ compensation systems are fully employer-funded through commercial insurance or through the creation of a self-insurance account, and nearly all states require employers to carry it. We have a much more sophisticated system of classification that has been tailored to fit each and every category of occupation, which allows insurers to provide infinitely more accurate compensatory rates to offer injured workers adequate compensation. The system, by nature, also carries incentives toward rehabilitating injured workers, which benefit both the employer and employee. And that’s why it’s so frustrating when we see people abusing and defrauding these systems that were created as a protection for them. The best thing we can do in our little piece of history is to make sure that these benefits are reserved for those who are genuinely entitled to them by proactively detecting, investigating, and reporting those questionable claims.

Sources:

- Insureon

- Encyclopedia Britannica

- Factinate

- History on the Net

- BBC

- World History Encyclopedia

- Lumen

- History.com

- Code of Ur-Nammu Image attribution: David Berkowitz from New York, NY, USA, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

- Code of Hammurabi Image attribution: John Ross, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

The Legend of “Nub City”

March 15, 2024Author: Olivia Maxwell

Vernon, Florida, Washington County: population 732 as of the 2020 census. A small town named after George Washington’s Virginia home, Mount Vernon. A small town which, from the 1950’s through the 1960’s, was responsible for nearly two-thirds of all the loss-of-limb accident claims in the U.S., earning the legendary nickname, “Nub City.”

Before becoming infamous for a widespread insurance scam, in which its citizens purposely dismembered themselves for large payouts, Vernon was the idyllic small town you’d see in television shows and movies. At least it was, until economic despair struck the people of Vernon.

Steamboats and trains no longer passed through Vernon, and the sawmill, where many residents once worked, closed its doors. Younger generations left for college and never looked back, leaving the town in dire straits. Desperate and down on their luck, the people of Vernon sought new tactics for acquiring cash quickly. In the coming years, nearly 50 citizens of the town would “accidentally” lose a limb in an attempt to receive compensation. These people would later be referred to as the “Nub Club.”

Although the origin of this scam is not known, it is believed that, at some point, a large payout occurred due to a lost limb. Word spread through the small town, and the rest is “mostly undocumented” history.

The trend was first publicly mentioned in an NY Times article written about an investigator, John J. Healy, who reported that “Nub City” was among the worst cases of his career investigating insurance claims (yes, they had investigators, even then). Healy had been hired by Continental National American Insurance group after claims in the Florida panhandle began to exceed $100,000.00. According to Healy, “Vernon’s second-largest occupation was watching hound dogs mating in the town square, its largest was self-mutilation for monetary gain.”

Healy wrote in one report, “Watching anywhere from eight to a dozen cripples walking along the street, gives the place a ghoulish, eerie atmosphere.”

Vernon’s fame persisted when L.W. Burdeshaw, an insurance agent in Chipley, told the St. Petersburg Times that his list of policyholders included a man who sawed off his left hand at work, a man who shot off his foot while protecting chickens, a man who lost his hand while trying to shoot a hawk, a man who somehow lost two limbs in an accident involving a rifle and a tractor, and a man who purchased a policy and then, less than 12 hours later, shot off his foot while aiming at a squirrel.

As more and more of these lost limb claims were filed, the payouts became larger. Some residents even took out ridiculously high insurance policies directly before the “accidents” occurred and provided even more ridiculous justifications for the accidents. Another investigator, Murray Armstrong with Liberty National, claimed that there was one man who took out insurance with 28 or 38 different companies before filing his claim.

Despite the blatantly obvious red flags, it was next to impossible to convict these claimants of fraud. Juries had a hard time believing that anyone would willingly amputate or mutilate their own limbs or appendages. One farmer reportedly walked away with nearly a million dollars from a claim for a lost foot, even though all the evidence pointed to self-amputation.

The scamming finally came to an end in the 1960s when insurance companies wised up and increased their premiums. Some companies even stopped doing business in the Florida Panhandle altogether.

Decades later, documentarian Errol Morris became intrigued by Vernon’s scandalous history. He met with Healy to dig deeper and find out more about this mysterious place Healy had mentioned in the Times article. Healy warned Morris that the people of the town were not fond of outsiders poking around (for obvious reasons), but Morris moved to the area despite Healy’s advice. He began working on a documentary to be titled Nub City. The premise and name of the documentary quickly changed after Morris learned for himself why “Nub City” has become more of a rumor than documented history. Morris knocked on the door of a “Nub Club” double-amputee, whose Marine son-in-law then allegedly physically assaulted Morris for asking questions. That was all the convincing it took to change his documentary’s title to “Vernon, FL” and refocus the film on the interesting characters who still reside in the small town after all these years.

If you find the time to watch the documentary, you’ll see the town has put the gory past far behind them. They are more focused on turkey hunting, wigglers, and growing sand. And while it’s not uncommon for the older residents to be missing a limb or two, they are back to their same old small-town living, acting as if the legend of “Nub City” is in fact just that, a legend.

Sources:

Vernon, FL (1981) by Errol Morris

Vernon, FL image attritibution: Florida Royalbroil, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

Errol Morris in 2013 image attribition: Ross from hamilton on, Canada, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

Don’t Lose Sleep: Sleep Disorders and Workers’ Compensation

October 27, 2023Author: Olivia Maxwell

Sleep disorders are common and often undiagnosed. According to the National Institute of Neurological Disorders and Stroke, approximately 40 million people in the U.S. suffer from long-term sleep disorders, and an additional 20 million people suffer from occasional sleeping problems. The fatigue from these disorders is not only a safety concern within the workplace, but also could become a huge financial burden for employers if working conditions or schedules are found to be a contributing factor to someone’s inability to sleep normally.

What are sleep disorders?

Sleep disorders can be described as a lack of sleep caused by something other than binging Netflix, staying out late at night, or consciously choosing another activity instead of sleeping. Sleep disorders are serious conditions that can cause impairment during the day. There are various types of sleep disorders with different effects on a person’s mental, physical, and emotional well-being.

The most common type of sleep disorder is Insomnia. Insomnia can make it difficult to fall asleep, hard to stay asleep, or cause you to wake up too early and not be able to get back to sleep. Short-term (acute) insomnia lasts for days or weeks, while long-term (chronic) insomnia lasts for a month or more. Insomnia can sometimes be associated with other medical conditions or medications.

Obstructive Sleep Apnea is a sleep disorder that causes a person to stop breathing repeatedly during the night. Many with sleep apnea suffer from other health problems that are exacerbated by their sleep disorder.

Restless Legs Syndrome is a condition that causes an overwhelming urge to move the legs, usually because of an uncontrollable sensation. This condition can often disrupt sleep as it typically happens in the evening or nighttime hours while sitting or lying down. This condition can begin at any age and generally worsens as you age.

Shift Work Disorder, also known as circadian rhythm sleep disorder, largely affects people who work during the night, in the early morning, or rotating shifts. This sleep disorder is characterized by insomnia, excessive sleepiness, or both, and affects people whose work schedules overlap with the typical sleep period.

Sleep is crucial to our overall health. Adults need an average of seven to nine hours of sleep each night, but 30% report averaging less than six hours. Chronic sleep-deprivation can cause depression, obesity, cardiovascular disease, and other illnesses, and is estimated to cost employers $136 billion per year in health-related lost productivity.

Common risk factors for sleep disorders include working second or third shift, obtaining less than seven hours of sleep per night, commuting longer than 30 minutes one-way to work, and having less than 12 hours off between shifts. Because of this, jobs like factory workers, nurses, police officers, firefighters, doctors, medical students, airplane pilots and air traffic controllers, truck drivers, senior management, and network administrators are all at high-risk for sleep disorders.

While an injured worker can pursue a claim for a work injury that results in a sleep disorder, there are limitations as to whether one can claim permanent disability as a result of a sleep disorder. In California, the current law indicates that there shall be no increases in impairment ratings for sleep dysfunction arising out of a compensable physical injury. However, if the sleep disorder is the direct result of an incident that occurs at work, such as a stressful or traumatic event, the employee may be eligible for permanent disability.

These specific laws vary from state to state, but getting treatment for sleep disorders through a workers’ compensation claim is possible as long as the employee can reasonably prove that the sleep disorder was either caused by or worsened by work, which is standard for any work compensable injury.

The determination of whether or not the sleep disorder was caused by or worsened by work is left up to the QME or AME. The medical evaluation will determine the diagnosis and medical causation. Determination of liability of sleep disorders lies solely on the medical evaluation. However, helpful tools such as a medical facility canvass can help the employer or insured determine if there was previous treatment for the sleep disorder, which may be helpful in mitigating claims.

Not only can sleeping disorders become workers’ compensation claims themselves, but they can often lead to other work-related injuries. Research suggests that around 13% of all work injuries could be due to sleep problems. Sleeping disorders can cause difficulties concentrating, decreased hand-eye coordination, slowed thinking/reaction time, reduced attention span, worsened memory, poor/risky decision making, lack of energy, and mood changes, all of which can easily turn into a dangerous situation in the workplace. Highly fatigued workers are 70% more likely to be involved in accidents. In one recent case, a ferry captain suffering from fatigue failed to prevent his ferry from striking a ferry terminal, causing $10.6 million in damages to the boat and piling. Investigators determined that the captain had become briefly incapacitated during a microsleep episode, which caused him to lose control of the vessel.

Regardless of who is held liable for the sleep disorder, it is clearly important that employers and insurers are actively helping to educate and prevent disordered sleeping amongst employees. This will, in turn, help to decrease other work-related injuries altogether.

When possible, employers should avoid rotating shifts, offer ample time off between shifts, ensure a work-life balance is prioritized, and provide flexibility for employees who may be struggling with lack of sleep. Workplace environments can also be modified to increase alertness with lighting, temperature, and noise, and can incorporate dedicated break rooms or even nap rooms. Making these changes may result in higher levels of productivity while lowering safety risks and the potential for workers’ compensation claims down the line.

Providing employees with the information and tools to understand and improve their sleep is a great place to start. Encourage employees to establish a regular bedtime routine, avoid caffeinated drinks such as soda, tea, and coffee before bed, minimize stress, and exercise regularly to ensure a good night’s rest.

Know the signs and symptoms of when someone should seek treatment for a sleep disorder, and where they can go for help. For more information, visit the CDC’s website below:

Sleep: An Important Health and Safety Concern at Work (cdc.gov)

Additional sources:

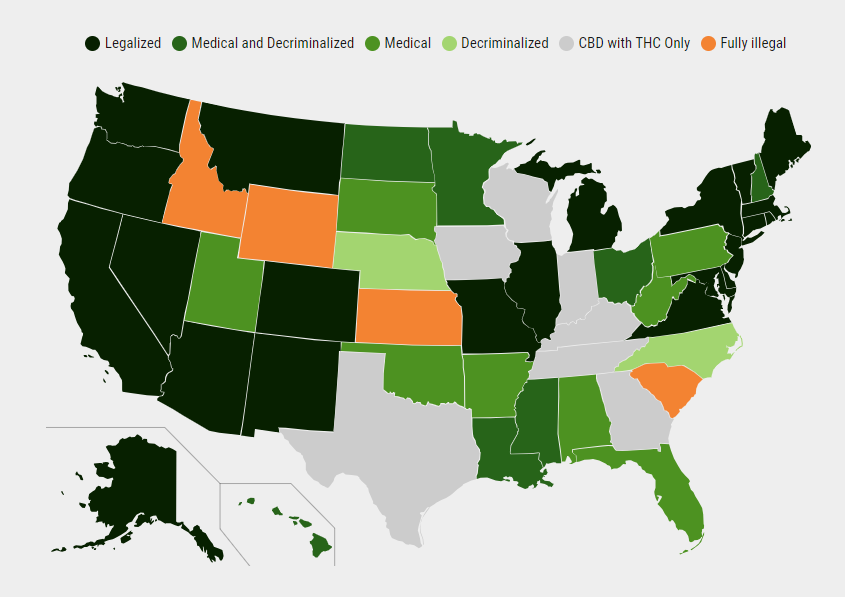

High Stakes in Workers’ Compensation

July 28, 2023How the legalization of marijuana is affecting the Workers’ Compensation industry

Author: Olivia Maxwell

Over the last few decades, the topic of marijuana legalization has been a tough one to avoid. It started in 1996 when California became the first state to legalize medical cannabis, with many states following, and now with some states even legalizing marijuana for adults’ non-medical use. The movement in favor of legalizing medical cannabis usage only continues to gain momentum, but its potential impact on the workplace have left many legislators, insurers, and employers feeling dazed and confused.

As of 2023, 38 US states, three territories, and the District of Columbia have legalized the medical use of cannabis products. There are also two US territories and 24 states including the District of Columbia that allow adult non-medical use of cannabis. Additionally, there are approved measures in 9 states allowing the use of “low THC, high cannabidiol (CBD)” products for medical reasons in limited situations. For additional details on the status of legalization of marijuana in the U.S., click here.

While some states have legalized its use, it remains illegal at the federal level. However, the states are able to circumvent this because of recent laws that prohibit the federal government’s interference with individual states’ medical cannabis laws, the legalization of low-THC hemp and hemp products, and cannabis research for medical purposes. The evolution of marijuana’s legalization is ongoing, but without federal regulation, there are many gaps in the knowledge guiding employers’ workplace policies surrounding its usage.

As the laws adapt, employers must adapt, too. Important considerations for employers when revising company policies regarding marijuana usage include employer liability, employee safety, and laws that prohibit unfair discrimination. On one hand, federal laws protect employers who choose to completely prohibit employees from partaking in recreational marijuana, whether legal or illegal in their state. However, this could be considered discriminatory if an employee is using marijuana for medical reasons with a proper prescription, and their use does not pose a potential safety concern for other employees. It is best to consult with a lawyer when implementing specific policies in the workplace to ensure the policies are not discriminatory. Keep in mind that many employers consider their employees “at will” and reserve the right to terminate for any reason, so users beware.

There are several steps that employers and insureds can take to ensure that company policies are up-to-date with current research and regulations regarding employee marijuana usage. First, it is recommended to revise any existing company guidelines surrounding substance use to include terminology such as, “subject to change,” or “individual circumstances permitted upon review.” Having a lawyer review these policies before implementation is always best practice. Next, understanding the differences between impairment testing versus drug testing, and when to use each, will help determine the best response to incidents, accidents, and injuries in the workplace. Drug testing can measure the presence of drugs or their metabolites in a person’s body at the time of an incident. However, because some drugs, including marijuana, can remain in a person’s system from anywhere from days to weeks, an employee can test positive for drugs without showing signs of impairment. Therefore, impairment testing can assess a person’s current state of intoxication, and establish whether the employee is actually impaired at the time of the incident. See more details about drug testing versus impairment testing here.

Another factor for employers to consider is whether workers’ compensation benefits will cover the cost of medical marijuana, should it be prescribed to alleviate pain from an injury. The pain management offered by the use of medical marijuana may allow employees to return to work sooner, but the risks associated with an employee potentially being impaired while on the clock could create safety and liability concerns. However, it is important to note that many studies have shown that medical marijuana is a much lower-risk solution for pain mitigation than opioids, and is less likely to result in addiction which could actually prolong the return-to-work process. Further research, including more comprehensive and long-term studies, are still needed to better understand the relationship between medical marijuana use and workplace safety.

While research is still ongoing and laws are changing, employers must take a proactive approach to mitigating workers’ compensation claims that involve the use of legalized marijuana. Reviewing employees’ backgrounds for any history of drug or drug-related charges, canvassing medical treatment facilities and rehabilitation programs, and surveilling claimants to document any evidence of substance use before entering the workplace may be helpful resources that a private investigation agency can provide. Of course, employers should do all they can to prepare for these claims before they happen, and to obtain impairment testing at the time of the incident, but a thorough investigation can act as a safeguard to ensure all bases are covered in the event of any legal challenges.

The topic of marijuana in the workplace is certainly a multi-faceted subject with many points for employers and insurers to review and consider. It is best to stay on top of incoming research and continue to adapt and re-review policies frequently for the best possible outcomes. The CDC and The National Institute for Occupational Safety and Health (NIOSH) are trusted organizations to follow regarding workplace safety and the use of marijuana as it continues to evolve. But know that in the ever-changing world of insurance and workers’ compensation, there are always trusted private investigators staying educated and adapting to the claims world in order to better assist in all of your claims’ investigations.

Sources:

State Medical Cannabis Laws (ncsl.org)

Cannabis and Work: Implications, Impairment, and the Need for Further Research | Blogs | CDC

Injured At Home

September 16, 2022Are remote workers eligible for Workers’ Compensation?

Author: Olivia Maxwell

You are probably already aware that Workers’ Compensation is a government-mandated program that provides benefits to workers who become injured on the job, or as a result of the job. This program has expanded and evolved over thousands of years to suit various societal constructs, and it’s looking like it may need to be adapted once again. Working from home, while not an entirely new concept, has become much more predominant in our society since the beginning of the COVID-19 pandemic in 2020. When non-essential businesses were required to shut down, many made the switch to a work from home environment in order to safely maintain their operations. Fast forward to present day, and that work remote environment hasn’t changed for many Americans. In fact, a recent study suggests that 45% of people still work from home in some capacity, with approximately 15% of people working from home full-time, and the other 30% on a hybrid schedule.

The expansion of the work from home model has transformed the way people view and feel about work. For many, the idea of “work” is no longer associated with rush hour commutes or chats around the water cooler. Board rooms have been replaced by web cams, and the demand for business casual attire has declined while loungewear sales are at an all-time high.

There are certainly advantages to remote and hybrid positions, and many employees are reaping the benefits of greater flexibility and an improved work-life balance. But allowing employees to work from home is not without its challenges. Many employers struggle with concerns about productivity, access to software and technology, security issues, and employee safety.

The concept of employee safety in the remote environment is a new consideration for many businesses. The unfortunate reality is that work injuries can still occur, even at home, and workers compensation policies and regulations have been slow to adapt in response.

Can an injury that happens in someone’s home really be considered compensable? The answer is yes, but there are a lot of gray areas, and those gray areas create a wealth of opportunity for those who wish to abuse the system. The ability to claim workers’ compensation for injuries sustained from working from home can lead to an increase in false claims, and in turn, more fraud.

Consider this scenario: an employee, who spends most of her working time traveling to see customers, is at home putting some work materials in her vehicle before her next appointment. As she walks out her back door into the garage, she trips over her dog and falls, sustaining a wrist fracture. Is the injury compensable? The actual answer wasn’t so simple, as this exact situation was seen in the case of Sandberg v JC Penney Co Inc. The employer initially denied compensation to the claimant based on the idea that the employee was not exposed to the risk of tripping over her dog as a result of her employment, but from her home environment. However, when the claimant took the case to the court of appeals, the decision was remanded and reversed. The court ultimately ruled in favor of the claimant because the employer could have offered her an alternative space to store work supplies where safety was within their control. Instead, they willfully allowed the employee to keep supplies in her home garage, which is where the injury was sustained. This case is a prime example of how difficult it can be to account for the many liabilities of employees working from home, and the consequences of overlooking potential risks in the home environment.

For a variety of reasons, which are certainly not limited to the risks associated with allowing employees to work from home, some companies are finally attempting to shift back to in-office operations. Most recently, companies like Apple and Google have announced their return-to-office plans, and have received massive push-back from their employees in return. This push-back may motivate employees to falsify or embellish injuries and disabilities, suddenly claim they have a condition that requires accommodation, or simply decide to quit in order to avoid returning to the office setting. In any case, companies and insurers are preparing for a multitude of risks associated with bringing employees back to the office.

With the many gray areas and “what ifs” that work-from-home trends bring to the table for the Workers’ Compensation industry, employers and claims representatives will need to shift their strategies in response. Thankfully, our friends at The Hartford have put together a list of ways to protect employees as well as business owners as they prepare for home-based claims. One measure that employers can take is to require their work-from-home staff to complete a safety survey, or even inspect their home offices to ensure that they are using equipment that is properly designed and located in an area with adequate lighting and ventilation. It is recommended that the work environment is checked every six months, and that employers keep photos for their records. Another step that can be taken is to assign the employee a dedicated workspace within the home where they will complete their job duties. That way, the risk of an injury claim is limited to incidents that occur within that space. Most importantly, experts at The Hartford suggest that employers speak with their insurance companies to make sure that coverage extends to home workstations.

It’s important to stay ahead of the fraud curve by educating yourself about the emerging trends and risks. But being able to identify those red flags and questionable claims is only half the battle. These injuries will largely be unwitnessed, and therefore much more difficult to disprove. Having a reliable investigation agency that is willing to get creative while helping you validate a claim is essential when mitigating these new types of fraud. Consider asking your investigation company to conduct a scene investigation of the workspace or take a recorded statement to reconstruct the events that led to the injury. Surveillance can also be an effective means of determining the true extent of injuries claimed, and Facility Canvasses can be a useful tool for verifying if an employee’s condition is valid. Claimants are nothing if not crafty, but the right investigation company will always be one step ahead.

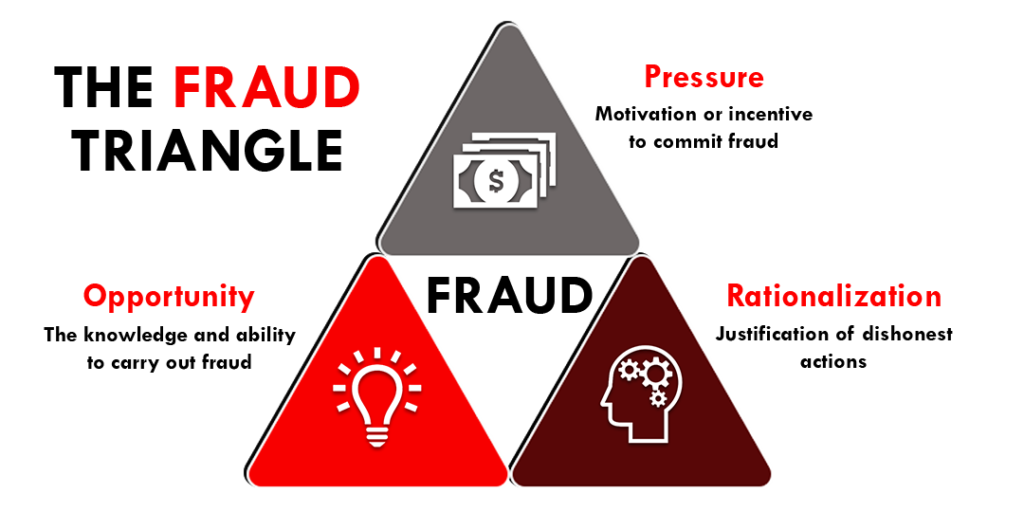

Desperate Times

August 11, 2022Insurance Fraud in an Economic Recession

Author: Olivia Maxwell

The past few years have undoubtedly challenged both industries and individuals in a variety of ways. But as many of us attempt to return to a sense of normalcy, there are some lasting changes that are just too difficult to ignore. Price increases, labor shortages, supply chain disruptions and geopolitical unrest have left many of us questioning if an economic recession is imminent.

According to the National Bureau of Economic Research, formally, we are not in a recession at this time. The indicators of a recession include quarterly Gross Domestic Product (GDP), unemployment rate, housing prices, stock prices, income level, and manufacturing industry health. To officially be in a recession, our nation must undergo deterioration for more than two consecutive quarters – deterioration that is measured based on the aforementioned indicators. Today’s economic conditions are setting off alarm bells for many Americans who experienced our most recent official recession, The Great Recession of 2007-2009. That all-too-familiar perfect storm is brewing, and the pressure is building as families figure out how to weather it.

That pressure is the first piece of what experts call the Fraud Triangle. Coined by Dr. Steve Albrecht, the Fraud Triangle theory is used to explain the reasoning behind an individual’s decision to commit fraud by resolving the “why” and the “how.” The framework of the Fraud Triangle involves three components: (1) a perceived pressure, usually due to financial stressors; (2) rationalization; and (3) an opportunity to actually carry out the fraud. We see those three elements more frequently during economic downturns and recessions as financial strain becomes more prevalent and people feel they are forced to take drastic measures to stay afloat. That first element, pressure, may present itself in the form of wanting to maintain one’s lifestyle despite inflation and rising costs of living. Wide-scale layoffs are also more common during recessions, and people will face pressures when paying bills. Regardless of the specific reason, pressure inevitably increases during recessions as people struggle to meet their basic needs.

With the economic trajectory looking grim and pressure mounting, many will feel forced to seek out alternative sources of income to take care of themselves and their families. For some, those alternative sources may not be legitimate. Economist Gary Becker, a Nobel laureate, developed a theory that, in some cases, committing a crime was a rational decision – that a person would only commit a crime if the expected utility exceeded that of using his time and other resources in pursuit of alternative activities, such as leisure or legitimate work. Financial hardship causes more people to justify things that they may not normally do, such as abuse their insurance policies, exaggerate a claim, or fake a claim entirely for their own personal gain. This justification, or rationalization, is the next piece of our Fraud Triangle. People are more likely to rationalize their dishonest behavior if they feel they have no other choice. They may even feel that it “doesn’t hurt anyone” or that they are somehow entitled to a financial gain.

Along with the anticipated increase in fraudulent claims during a time of economic uncertainty, legitimate insurance claims are also likely to rise in response to financially-motivating crimes, such as theft. Now, more than ever, it is important for those in the insurance industry to stay vigilant. However, it is also in the realm of possibility that claims professionals will have to cut costs of their own during tough times, whether that is through downsizing, layoffs, or reducing investigation costs. This combination of more claims and fewer resources leads us to the third piece of our Fraud Triangle: opportunity. Frauds who have the knowledge and ability to carry out their insurance scams will now also have less oversight while claims professionals are spread thin.

Insurance crimes are not victimless crimes, and these actions are never justified. As investigators, we are well-equipped and prepared to help you get to the bottom of those questionable claims and determine when it’s time to engage the SIU. Through our SIU & Fraud Abatement Program, we can also educate you on how to identify red flags as well as those situations where the pressure, rationalization, and opportunity have turned an ordinary claimant into an overnight fraudster.

Hard times for some can mean desperate times for others. But a strong collaboration with your investigation agency will help you remain tough on fraud while we all navigate the uncertain economic future.

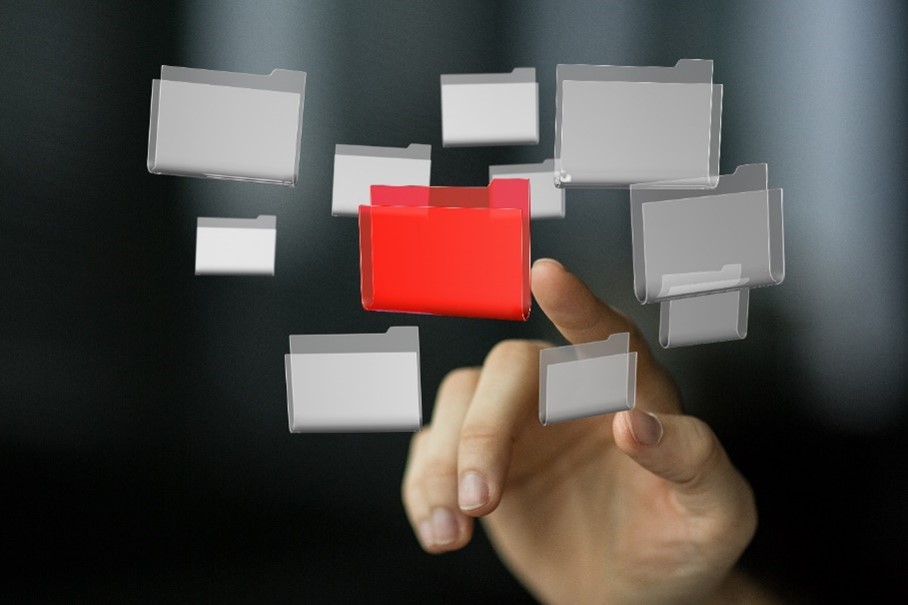

Man VS. Machine

July 21, 2022Is manned or unmanned surveillance better for your claim?

Author: Olivia Maxwell

The ultimate showdown between manned and unmanned surveillance

As technology evolves, so does the world around it. Machines and robots are slowly developing and taking over more and more jobs that were once specific to humans. Private investigating is not immune to these developments. We see surveillance systems almost anywhere we go, and many people even have these systems in and around their homes. As these unmanned surveillance systems become more common, it begs the question of whether real, live humans are even needed for surveillance anymore.

Fortunately, as a private investigation agency, we are not obsolete just yet. There are benefits to both options of manned and unmanned surveillance, and they both make up for what the other lacks. If you’re in the market for surveillance, then it is important to know when to choose which option and how either option can potentially benefit your specific case.

Out of sheer bias, we’ll start with the benefits of manned surveillance. The flexibility and adaptability of a human private investigator is unequivocally superior to any unmanned technology, as there are still many things humans can do that technology can’t replicate. For example, private investigators can use pretexting to verify if a person of interest is even in the residence that they are surveilling, and oftentimes develop more information about the subject and their schedule simply by talking to neighbors in the surrounding areas. Us human investigators are also readily available to go mobile to continue surveillance once the claimant has left their residence. After all, we can often obtain some of our best footage while on the move.

There are many variables constantly in play when doing surveillance, things like weather and traffic can impact visibility during surveillance, and a trained investigator is nothing if not adaptable. Since private investigators are not immobile, they’re able to easily move positions, switch angles, adjust the camera to ensure in real time they are obtaining the best possible footage of whomever they are surveilling.

Now, manned surveillance is not without its flaws, and unmanned surveillance systems can certainly make up for what manned surveillance is lacking in some ways. Often it can be difficult to find the perfect vantage point on some homes depending upon their neighborhood setup. Apartment buildings, rural areas, and close-knit neighborhoods that are more aware of unfamiliar cars on their street are instances where unmanned surveillance systems might be a better option. These systems are inherently more discreet, easily concealable, and can be positioned and mounted in a variety of locations. These systems also have the benefit of time. Depending upon the battery life, these systems can be left to obtain footage for much longer than a private investigator can go without sleep and other human necessities. Plus, labor laws don’t exactly apply to robots just yet.

Speaking of laws, this is another issue that comes into play when discussing the differences between a private investigator and unmanned surveillance systems. Many states already cover their bases with laws regarding the conduct of private investigators, and have policies in place to ensure that any evidence obtained by a licensed professional will be legal and admissible in court. Unmanned systems are not yet regulated as closely, and there is the potential for argument or debate when it comes to what is, and what will be, allowed in a courtroom. There are still some gray areas surrounding the ethical implications of unmanned systems, especially when it comes to privacy laws. For example, the state of Georgia has already established that any unmanned surveillance camera must be in plain sight, which sets a precedent for where things might get questionable down the line.

With all of that said, this information does not necessarily prove that one option is explicitly better than the other. However, this information does highlight which situations are better suited for either option. Knowing the benefits and shortcomings of both options, along with the details of your case, will help you (or your investigation agency) to choose the best option to help you get more “bang for your buck.” Hiring a private investigator who will give you those honest recommendations, regardless of cost/profit for them, is extremely important in obtaining the best results possible.

- 1

- 1-9 of 9 results