Interview with The Insurance Fraud Experts

December 17, 2025

Contributing Authors: Emily Epps and LJ Teske

For International Fraud Awareness Week, we took the opportunity to sit down with Merge Investigations’ fraud experts, Chris Will and Sue Fernandez. Chris has been Merge’s Director of SIU since 2018, joining us to continue a 30-year career in SIU compliance and investigations. He’s been developing fantastic anti-fraud training materials and managing nationwide SIU reporting programs since 1998, and before that, he was directing claims investigation teams in the field. Sue is our SIU & Compliance Manager, reaching her 10-year anniversary with us this year. She’s previously worked as an insurance adjuster, field investigator, and desktop SIU investigator, and has extensive experience with corporate training, depositions, and court hearings. She holds a Senior Claim Law Associate (SCLA) designation from the American Educational Institute (AEI), which marks the maximum level of achievement attainable from that organization.

What is the SIU Department?

Chris Will: Well, SIU, for people who don’t know what those letters mean, it’s Special Investigations Unit. In its most basic form, SIU would be the department that’s charged with investigating fraud, determining if there is potential fraud in a case, then working that case and providing it to the appropriate Department of Insurance or law enforcement for a referral for criminal prosecution. We work with that law enforcement or Department to determine if the suspected or potential fraud is indeed fraud. Then, if there is a prosecution, we work with them until that prosecution is over, and then hopefully collect restitution for our clients.

What types of fraud do you investigate?

Chris Will: Most frequently, we will get workers’ compensation cases, property cases, and liability cases to investigate, but we investigate all types of fraud. Then there are various types of fraud present within those different lines of business.

Sue Fernandez: A lot of it hinges on what kind of clients we’re getting and what kind of business we’re writing, because [it] used to be – I did workers’ comp on all my cases, right? I really didn’t do auto, home, or anything like that. And honestly, I loved it. We have a lot of roofing claims right now because that is what our client base needs. Right now, we get a lot of background investigations that can lead to SIU from auto accidents.

Where do the cases you work come from?

Chris Will: Usually, we will get a case when either the adjuster or someone else in the claims process has identified some red flags in the claim, or some suspicions that there may be potential fraud occurring, and they will refer that to the SIU. We’ll get that usually from an adjuster or other claims personnel, and sometimes it comes out of investigations as well. For example, surveillance, where a claimant is potentially performing all sorts of activities, and they had previously stated to a doctor or claims adjuster, or someone else, that they can’t perform these activities. They say that they just basically stay inside all day, and they can’t do anything. But we got them mowing the grass, working on their roof, or working another job – those types of things.

Sue Fernandez: When the surveillance is done, and [the adjuster] will tell the surveillance investigator, “this guy said he can’t drive.” That’s an easy one. He can’t drive, but the surveillance investigator documented him driving everywhere. Now that’s probably going to come to SIU. And that’s where we have to determine what’s what. And it’s all a puzzle. I mean, it is literally a puzzle where it’s like, “OK, we’ve got this, this, and this, but we’re still missing a piece.” That can be frustrating because we still have to prove it.

A lot of times, adjusters will refer cases a year and a half later, and we’ll say, “why didn’t you refer it earlier when you had evidence?” And they’ll say they couldn’t prove it at that point, and “that’s not their job.”

If they find the red flags, which they are taught about during our trainings, then it should be reported to SIU immediately.

Chris Will: Yes, because SIU can assist early on. We can start the investigation, and we can make recommendations. Maybe surveillance, a background check, a social media investigation, or if it would be wise to get a recorded statement. It’s always best to get SIU involved as soon as red flags are identified.

What is Anti-Fraud Training?

Chris Will: The training is to make sure that we educate our clients about what exactly is insurance fraud. We provide definitions of fraud, the state statutes in the states that they handle, the requirements for them, identifying and referring fraud to the SIU, how to report fraud, and what their duties are. We provide a number of red flags as well for the various lines of business that they handle, and we make sure that those lines of business or red flags are specific to their organization.

Sue Fernandez: A very important part that Chris said – you would think fraud is fraud, right? But a roofing claim piece of fraud, versus a self-storage, versus a workers’ comp, they all have very different red flags. In workers’ comp, a red flag could be that the employee knew they were about to get fired, or that they were on their last write-up. But with roof damage, we will have specialists inspect the damage and they can tell when it’s man-made.

Chris Will: We will also provide the state statutes that are specific to the states in which they operate to let them know the requirements. The states can enforce harsh penalties for not reporting fraud, so that is also something we cover during our trainings.

Who is recommended to receive the training?

Chris Will: As far as who’s required to take the training, we generally go by California standards because California is one of the strictest states in the country. If you adhere to all the California regulations and statutes, you’re generally going to be compliant no matter where you work. California requires, what they call, “Integral Anti-Fraud Personnel” to take the training. And those are people involved in the claims process, which includes claims adjusters, underwriters, legal professionals, even call center staff. Basically, anybody who touches a claim should take the training.

So if a call comes in, the call center staff takes information over the phone and says, “OK, when did the claim happen? What’s your name? Give me some specifics.” And then they are responsible for forwarding it on to, say, an adjuster, or another member of staff – they should take the training. Anybody that works with a claim in any way really should take the training.

Now, we have some clients who will require every person in their organization to take the training. They want everyone to be educated and aware. There’s no harm in that at all, of course, but some of those employees may not be required to take it. But like I said, training should be extended to anyone involved in the claims process from the very beginning to the very end. Even legal staff should take the training as well.

Why can’t the adjuster investigate the fraud themselves?

Sue Fernandez: One, they have so very many claims to handle, and two, they have to keep any thoughts of potential fraud separate from handling the claim. They can’t say, “oh well, I think this person isn’t telling the truth. I’m not going to pay their benefits, or I’m not going to pay to repair their roof.”

They need a separate entity, which is the SIU, to evaluate that and determine if that fraud appears to exist.

Chris Will: Yes. And Sue made a good point on that. The adjuster, and their investigation, and the SIU investigation – we always say they run side-by-side. The adjuster shouldn’t be making claim determinations based on, “oh, I need to wait and see what SIU comes up with to make my claim determination.” They have to basically work their claim while we’re working our investigation. So they run side by side, and our investigation has to be pretty much – well, I don’t know if I would say independent –

Sue Fernandez: Parallel. That’s the word we like to use.

Chris Will: Parallel. Right, exactly.

Sue Fernandez: I think the biggest misconception is that, if you think it’s fraud, you can stop the benefits, or you don’t pay the claim. And that’s not true. The adjuster still has to follow the rules and regulations of that state until the fraud is proven, or sometimes maddeningly, they have to settle the claim even though we know we’re so close to prosecuting fraud because they can’t say, “oh well, you know what, we know it’s fraud, so we’re not going to settle it.”

I’ve had a couple of attorneys who will think, “OK, we’re going to tell them that we’re going to report them for fraud if they don’t settle for X amount.” But you can’t do that. You can’t use fraud as a threat on the settlement. So that’s another misconception, is that people think an adjuster can look at it, say it’s fraud, and shut down the claim. But they can’t.

How can you prove that it’s actually fraud?

Sue Fernandez: We can think all day long that it’s fraud. Frankly, we can know that it’s fraud. But we can’t prove that if there’s not a deliberate lie.

That’s one of the things that will stop that case from moving forward. And so, we love to get them on a recorded statement, and I’ll flat out ask them:

“Did you take these photographs?”

“Yes.”

“Did you take them the day of the loss?”

“As soon as the manager told me about it.”

“So you didn’t get them anywhere else. Did they go onto your computer?”

“Nope. I took them on my phone…”

OK, well, there you go. So you have to have that lie, and you have to have that before they can be criminally charged. Because, if you think about it, the balance is different, right? It’s beyond a reasonable doubt versus a preponderance of the evidence. So, that can make it a little frustrating.

Do you think fraud is increasing in frequency?

Sue Fernandez: I think it is going to continue to increase. When the economy is bad, it increases because people need money. Sometimes, they don’t make their claim intending to commit fraud. Some family member might say something, or somebody else tells them, “oh, I got X amount of money when I filed my claim.” So, when the economy is not good, fraud rises. And AI is going to make it easier for fraudsters in some ways, but in other ways it’ll make it a little more difficult, because insurance companies now have tools and analytics. For example, when the claim is filed, insurance carriers will be notified if someone has filed 10 prior claims.

In my opinion, it’s also going to increase because companies are also trying to do more with less people. You have adjusters who already had pretty high caseloads. Now you’re asking them to do more, which means they can’t look at it as intensely.

Chris Will: Comp cases, in particular, get really involved. And adjusters were supposed to have no more than 100 files at a time. The workload on the adjusters has really, really increased. So, you know, they don’t have the time to look at and investigate the claims like they used to.

What are some recent trends from fraudsters?

AI and Deepfakes

Sue Fernandez: With AI coming, that’s making huge changes in the industry, I would say, and Chris would probably agree, AI will probably be the most change that we’re going to see. People, or bad actors, are findings ways to go against the system by using AI. And I learned at a conference one time that people who do this kind of thing will either talk to each other, or they’ll go on certain website forums and say, “you know what, this insurance company will pay you really quickly. You should go through them. Or they don’t check to see if their invoices are real that we give them, so you should go to them.”

Chris Will: Yes, as Sue mentioned, AI, that’s really something that’s been playing more and more a part, and it will in the future as well. And even just simple things, it is really, really easy, especially like in the property realm of things, it’s really easy to generate fictitious pictures. I just got a Google phone recently and it has a bunch of AI features on it. I was able to just generate pictures of property damage that wasn’t real. I assisted in creating some training, and one of the examples I used – I just put the Pope on a bicycle. He was riding a bicycle! But of course, the Pope wasn’t riding the bicycle. You can just do all sorts of silly things, but you can also do very convincing property damage, like it looks like there’s roof damage, or you know, it looks like it flooded inside of a house. And you could do that really, really easily, unfortunately.

Sue Fernandez: Fraudsters can also use AI technology to alter their voices.

Chris Will: Yeah, and that is pretty scary. They can deep fakes and stuff like that. Basically, you only need maybe 12 or 20 seconds of a person’s voice to generate an entire conversation. We saw a demonstration at a conference where the speaker demonstrated it by having his wife on a brief phone call, and then he played for us what he generated. It’s scary!

Sue Fernandez: It was her voice, like admitting to an accident, saying, “oh my God, I’m so sorry I hit you. Can we not call the police and maybe handle this ourselves?” And he got that from that 12 seconds of her, I don’t know, talking about what they’re having for dinner. And it was very inexpensive, very easy to program. I was blown away.

Chris Will: There is technology as well to help with AI generation. There is metadata you can use in certain circumstances. Now, if the claimant is really smart, they can either erase the metadata or if they send it through e-mail, and since it’s not the original file, then the metadata won’t be included. But the criminals basically come up with one avenue, and then of course we have to come up with other avenues to try to investigate and determine if it’s real or not.

Digitally edited and faked documents

Chris Will: In the last, probably, 60 days, I’ve gotten two cases where both of them had fictitious invoices. They turned in an Airbnb invoice – one that was a really shoddy attempt. They didn’t even copy the logo from Airbnb. They spelled Airbnb wrong. So it was pretty obvious, and there were a number of other indicators as well. We had another case that was a much better attempt – they copied or had copies, somehow, of the letterhead of the business. And so they created a fictitious invoice, but through investigation, we found out that the invoice did not come from the business. They had no record of even providing the services. And so that’s been sent on to the state DOI to investigate.

Sue Fernandez: There’s another one right in the back of my mind that was a pretty good one. It was a plumbing claim and he provided the invoice, and they used all sorts of plumbing terminology. Everything that was written up looked legitimate. I’m like, “OK, this is odd,” but you could tell the phone number had been changed a little. So I started calling around, checking, and checking. I finally found a guy in the area who the claimant used to work for, and so he must have had some old invoices, and changed that number a little bit. It wasn’t a big company, so you could see where a small operator might think, “oh I changed my number,” but this actual plumber said, “oh no, I fired him years ago. He takes advantage of everybody in the city. This guy is scamming you.” And he [the suspect] did end up getting charged.

Reused and stock photos

Chris Will: Sue had a couple of cases where the people submitted pictures that were stock photos off of Google. Right, Sue?

Sue Fernandez: The stories I could tell over the storage claims! It’s become a niche that I did not know I needed in my life, but I did need it in my life because these people will just try so hard to thwart the system, and it’s really frustrating. I had a big one where they hit a bunch of self-storage facilities in Texas. They would rent the unit online, they wouldn’t even go into the facility. They would use pictures they’ve all taken from other ones. They would move one mattress in there. Later, we find out they didn’t even do that – they were that confident they wouldn’t get caught. They would move one mattress into one unit, take photos, and spread that to all of them. I think by the time I was finished putting them all together, it was going to be about $45,000 worth of claims, and these claims are a maximum of $5,000. So, that’s how many times they had done this. And the only reason it was caught was because two managers were at a meeting and realized the claims were related. I think four of those claims got paid before they realized it.

Chris Will: That’s a great point, too. In that case, it was a whole bunch of smaller claims that, in many instances, would just slide under the radar. I mean, a lot of times, adjusters will pay those small claims without too much thought. They put all these small claims in, and like Sue said, it turned out to be $45,000 because there’s like, 8 or 9 small claims that they put in.

Sue Fernandez: And then the other thing is that you’ll get people who lie about the photos they submit. They will say everybody had designer shoes – Gucci, Prada, Dior – everybody did. But then you’ll see all they had in the unit was garbage bags full of stuff. But when we would look at the picture, you couldn’t find it. It’s kind of clever. They wouldn’t go on the first page of a Google match for Dior shoes, they’d go in maybe page 4 or 5. And then they’d copy it. They’d say “oh yeah, here, this is my bag. Look at all these shoes I have!” But if you keep looking on Google, you’ll see the exact same photo they sent in.

Adding to legitimate claims

Chris Will: Sue made a good point earlier. People sometimes don’t intend initially to commit fraud. A lot of fraud will arise from people having a legitimate claim but then they add onto it.

You know, maybe a storm came through and it caused some of their shingles to blow off. “Well, we’ve been having that wet spot on the roof from three years ago that we never fixed. Hey, we’ll put that in too. And you know that old fence back there, it blew down a couple years ago, and we didn’t fix it, we’ll claim that as well.” So they’ll add on to their claim. It started off as an actual real claim with real damages, but they decided to add on some more damage.

Natural disaster and roofing scams

Sue Fernandez: For roofing claims, Florida just had a crazy, crazy amount! They have so many hurricanes. I have one guy that’s literally claiming every screw in his garage for a hurricane, and if you saw this claim, it would make you mad. It really has been the most disheartening because over all the insurance companies, this guy has defrauded – and he’s super aggressive, so they get nervous – he has gotten over $2,000,000 for this house, different claims. It’s not even his house, it’s his mom’s. I kept saying I thought she was dead because nobody has seen her.

And they just kept [paying] because he was so aggressive, right? And so, they’d be like, OK, well, we’ve got to pay because he’s reporting it to the Florida Department of Insurance, right? He’s saying we’re in bad faith.

This guy makes me angry because he’s filed a claim for his driveway, I’d bet at least eight times. And here’s the problem: he gets all that money, and he doesn’t fix the house. It could be a lovely property, but no, he doesn’t fix the house.

And, he posted online that he got a Porsche with the last big settlement that the client gave him. So, he knows how to work the system…and I digress on that one because he drives me nuts.

I made it a point at the last conference I went to, to learn about new topics. I learned that roofers would offer to go up onto a homeowner’s roof to perform a free inspection. But they would take quarters and make little digs with the quarters to look like hail damage. Some will even wear little things on their shoes to simulate weather damage. So they’re up there walking around doing this “free inspection,” but they’re the ones causing the damage. That’s why we have to send an engineer out to look at it.

Florida’s problem was that they didn’t have any laws in place to prevent this, and didn’t anticipate roofers would be so aggressive. Florida started making laws to try to contain that. But quite honestly, it was so blown up at that point. Insurers were leaving the state, so now the problem is in Pennsylvania, Delaware, Maryland.

Another trend that is kind of region-specific, is that these roofers will tell clients they won’t have to pay anything out of pocket at all. They’ll say, “we’ll be able to get you the money from the insurance company.” One, that’s illegal. Two, now they’ve kind of phrased it a little differently, where they’ll say, “all you’ll have to pay is your deductible.”

Are companies doing anything to combat rising fraud?

Sue Fernandez: One client has a roofing unit now, so if the insurance company inspector says, “this looks like it could be man-made damage,” they automatically spend the money to send an engineer. Smart. Yes, it’s some money up front, but you’re getting an expert out there, and they automatically refer it to us. I don’t have to dig deep, but you start seeing the same companies over and over and over. And I know that at least Pennsylvania is starting to look into them because I’ve noticed the last couple of file requests I’ve gotten, they don’t put the homeowner’s name, they put the contractor’s name. And that tells me they’re gathering evidence on particular contractors.

But insurance companies are now realizing they have to start containing it, and they have to start working together because otherwise, it’s raising, and raising, and raising. If they don’t find a way to contain it, they’re going to have to do like they do in Florida. They’re going to have to get out of that state. And then you’ve got big problems. It’s like those storage claims, I try to keep those pretty low-cost because I want them to keep saying, “OK. You know what, this is a benefit. We’re starting to see less.”

But you do feel kind of good when you know you’re allowed to spend a little more on the front end to hopefully pay off in the long run, like these roofing claims, it seems at first like a lot of these won’t go anywhere. But now that I see, oh, they’re looking at this contractor, they’re looking at this contractor, I’m happy to send them on because the more they get, the better it might be.

How many claims get referred to law enforcement?

Chris Will: How many do we refer to law enforcement on a percentage basis?

Sue Fernandez: That’s pretty high because by the time it gets to us, there’s suspected fraud. I would say 80%, probably.

Chris Will: Yeah, I would say about the same. There are some claims that we get that we still have to investigate, that the adjuster has identified the red flags and properly sent them on to us. But after our investigation, we were able to clear the red flags. Those cases still need to be sent because if law enforcement identifies red flags, there still needs to be an investigation. But many times, like Sue said, it’s probably 80% of cases that have the evidence necessary for us to send it to the state.

What are some reasons why law enforcement might not take on a fraud case?

Sue Fernandez: The problem is that law enforcement’s also busy with their own fraud units – it depends on grants. So, every year they write up grants and hope. We’ll even have officers call us and say, “do you have anything?” Because they got a lot of money in grants that year.

But if they don’t, there might be great cases, but they just don’t have the money left. And that is super frustrating. Chris and I realize that this is particularly bad in Florida, between county to county to county.

The state’s attorneys are different as to what they might take and what they might charge. So, you know, we try to package it up really nicely. First, they’ll get our initial referral. If they’re interested, they’ll send us a request, and we will then package it up for them, and we try to do that with a bow. Because think about it, if you have a whole bunch of work and this one’s a mess, you’re going to pick up that one that’s easier to do. I had [an officer] call just the other day, and he had some additional questions. I said, you know what, let me see what I can find out because I don’t want him to say, “this is going to just cause me too much work. I’m going to let this one go.”

Chris Will: Yeah, and like Sue said, initially we send a suspected fraud referral to the state. And if it’s something they want to investigate, they’ll send us a request. And then, like Sue said, we’ll package it up. And what entails is getting the entire claim file from the adjuster, any and all documents, photographs, things like that. We put it in a nice package with an index to everything so they can have everything at their fingertips.

Sue Fernandez: That’s my favorite part, I think, because I feel like that’s when you’re putting the puzzle together. You can see dates, and all of the exhibits, and they all tie together. I think that’s why it’s my favorite part. It goes back to the days of literal binders that would have to be put together, and we’d have to go down and copy them, or put the files on a DVD. But now everybody wants it emailed, which is much easier.

The other thing where I think Merge really stands out, and has always stood out, is some companies know what the regulations are. They know they have to refer a case for fraud if it meets certain basic qualifications, and some companies will just fly through those. They’ll just – I call it “top sheeting” – they’ll do exactly what the regulations say just to get these referrals out, so that they can handle maybe three or four a day. They’re not really doing an investigation.

I worked for a company like that, where you had to do a certain number each day. There was no way of knowing if I was really reviewing what I was supposed to review. Merge has always given us that flexibility, and the ability to investigate to the point that we need to – obviously keeping client costs in mind, but to do what we have to, and that’s always been something that stood out.

Chris Will: Yeah, because that’s another thing. If you don’t do a full and complete investigation, if the state audits you, especially in California, they will ding you on an audit for that. And two, you know, if you don’t have a really great investigation, again, law enforcement or DOI personnel is just going to pick it up, look at it, and say, “well, gee, they didn’t do their complete investigation, and they’re just going to put it aside.” The case isn’t going to go anywhere, so we want to make sure that we do full investigations. That way, when we go to submit it, there’s going to be a high probability that law enforcement’s going to pick it up and investigate it on their end.

Thanks to Chris Will and Sue Fernandez for taking the time to share their knowledge of SIU and fraud!

Want to refer a case to our SIU department, or receive anti-fraud training for your organization?

Click here or call us at 717-945-5399.

Inflation and Workers’ Comp Fraud Trends

August 5, 2025Author: Clark Fennimore

Workers’ compensation is an important part of company budgets. One consideration in the search for a coverage plan is the fact that workers’ compensation is among many areas of the economy influenced by inflation. In fact, small businesses often have a hard time with the amount of their budget that they have to dedicate to such a plan, particularly when premiums increase to accommodate inflation.

At the same time, many people seek opportunities for financial prosperity in the midst of inflation, leading some to desperate measures in the form of fraud, noted as a crime negatively impacting workers’ compensation, with annual losses in the United States estimated at $310 billion. Sadly, that figure increases over time. In fact, this crime takes forms labeled specifically as provider fraud, payroll fraud, and claimant fraud; these all directly impact workers’ compensation.

One important part of dealing with the financial state of workers’ compensation comes in the form of how an employer provides coverage for employees while mitigating the raising of premiums. First, a “modified duty” policy decreases expenses when used to accommodate an employee who deals with an injury, as litigation becomes less probably as an out come; in fact, disability coverage is contingent on using such an accommodation. Another alternative is providing a system for medical consultation at the workplace, including nurse triage (available over the phone).

Benefits of this system include quick consultation concerning an injury, with less expense to the employer, as well as the lack of a need for compensating the employee for time spent in seeking care away from the workplace. Some special types of coverage policies can also help with cost-effectiveness.

Another part of dealing with the financial state of workers’ compensation, including in the midst of inflation, is preventing fraud. One issue is that technology has opened opportunities for people to commit fraud. A strategy for preventing it also involves technology: the use of predictive analytics to monitor claims in quantities beyond the ability of adjusters, as a tool in finding cases of fraud. Because such cases can be discovered more quickly than they could be without this resource, financial losses due to fraud can be decreased, both for companies dealing with workers’ compensation and for companies that purchase plans. However, there is also a possibility that companies may offer coverage for client companies at an initially competitive premium level while planning to increase the premiums later.

While this has been identified as another potential form of fraud and of making money in the midst of inflation, employers can look for coverage from companies that do not use such practices to increase their profits; a covered employer can then avoid be a victim of fraud in this form.

Sources:

- https://www.insurancebusinessmag.com/us/news/wholesale/the-uphill-battle-for-small-business-workers-comp-why-affordability-and-fraud-are-top-concerns-529883.aspx

- https://www.chartwelllaw.com/resources/implications-of-recent-spike-in-inflation-on-workers-compensation-claims#:~:text=The%20recent%20surge%20in%20inflation,financial%20stability%20in%20the%20industry

- https://www.cytrongroup.com/post/does-inflation-lead-to-workers-comp-insurance-fraud

- https://www.ranchomesa.com/industry-news/inflation-increases-cost-of-workers-comp-claims

Before You Sign: Unmasking Contractor Scams

May 23, 2025Author: Clark Fennimore

Homeowners insurance is an important investment in the interest of keeping a home in good condition. Its importance has to do with many unforeseen circumstances in which professional work needs to be done on the structure of a house. One such circumstance comes from significant weather conditions that may damage the exterior and interior of a home. When such a type of weather hits an area, many homeowners in that area use their insurance to cover the needed repairs.

Consequently, there are ways that this scenario can lead to fraud, possibly at the hands of the contractor doing the work. The contractor, in such a case, often makes some type of unexpected offer to homeowners in the area about fixing their homes. Some even have a practice of looking for an area where some weather event is occurring so that they can solicit business from its residents for this purpose. They will notify the homeowner that they’ve located an area of the residence in need of repair, and convince them to file a claim with their insurance companies. However, these contractors will often create the damage themselves while the homeowner is distracted or otherwise unaware. Many of these false claims occur while a contractor is on the roof of a home. Homeowners can also commit fraud in a similar scenario, but by lying about details concerning the claim. With weather conditions as a significant type of circumstance for insurance claims, approximately 10% of claims involve fraud.

There are ways to make sure that work on one’s home is performed honestly. The initial step is contact with one’s insurer as a source of information before a contactor is even consulted. After that, a contractor is to be selected based on professional standards, such as if they have a license; consulting more than one before choosing is a good idea. Other important steps while making contact with the selected contractor include an official contract and continual awareness of the work being done. These methods give the homeowner knowledge to spot potential fraud, leading to the step of legal consultation and the involvement of a trusted investigation company if necessary.

Sources:

https://helpstopfraud.org/wp-content/uploads/2022/02/Homeowners-Guide.pdf

https://www.insurancebusinessmag.com/us/news/property/nicb-enlists-20-states-in-battle-against-contractor-fraud-490266.aspx

Artificial Intelligence In Claims: Friend, Foe, or Both?

April 24, 2025Contributing authors: Olivia Maxwell, Emily Epps, Clark Fennimore

AI (Artificial Intelligence) has been taking the world by storm over the last few years, improving efficiency, assisting in a variety of functions, and overall becoming a useful time-saving tool for a wide range of professions. Despite all the benefits that come with AI, there are, unfortunately, people who have been utilizing this super-tool for evil.

This is why we can’t have nice things.

Although still in its relatively early stages, AI already seems like it has limitless capabilities. Things such as image generation, deepfake videos, voice cloning, and the beloved ChatGPT, along with other LLMs (Large Language Models), are just a few tools AI has to offer. AI is in continuous development and improves its efficacy each day.

With its constant improvement, it is becoming harder to determine when something has been produced or altered with AI. While this would normally be a good thing, it means that it is also becoming more difficult for claims professionals to detect when AI has been used to manipulate insurance claims. Image generative artificial intelligence software, which produces high-quality visuals based on a prompt entered by the user, could be used to create false “evidence” of property damage, visible injuries that may not truly exist, and even fake x-rays and other medical records. Fraudsters can use voice cloning to impersonate a witness giving a statement, or mimic someone who is no longer living in order to collect social security and other benefits on their behalf. Deepfake technology, which can create artificial photographs or video footage, can also be used to impersonate witnesses, as well as to provide false documentation or obtain access to protected information. Lastly, LLMs can be used to create phony medical records, false police reports, other fake legal documents, and bogus billing statements or receipts.

As a claims professional, you may be reading this and thinking you now have to become some sort of super-human AI detector. This isn’t true at all. There are AI systems that focus solely on identifying the manipulation of images and documents that have been submitted as evidence, as well as detecting if an image has been copied from somewhere else on the internet. This technology can also sense when metadata has been tampered with; this surprisingly big industry (now paying people to alter metadata on photos) is the reason why even the FBI has issued a warning about criminals and fraudsters using generative AI).

Although AI can save time during the claims review process by scanning documents and statements to expose potential dishonesty and inconsistencies through behavioral analysis, and it can alert you when further investigation may be warranted, fraudsters can use AI to gain the upper hand. In fact, certain AI systems can even analyze body language, expressions, and speech in recorded media to identify dishonesty and assess credibility.

AI is reshaping the insurance industry as we know it, by analyzing large volumes of data and improving companies’ efficiency. However, that doesn’t take away from AI’s bias, which can lead to unfair outcomes, since certain AI algorithms can sometimes over-exaggerate pre-existing bias. This issue has led companies to question how ethical AI is and whether new ethical guidelines need to be put in place for these algorithms.

However, this isn’t a battle of humans versus AI, because we have the ability to use AI ourselves to detect others’ use of AI (this really could be the start of a great idea for a new movie series). By fighting fire with fire, we can use AI to deter fraudsters and gain the upper hand.

It is our responsibility to keep ourselves educated as AI technology progresses so that we may remain hypervigilant in the fight against insurance fraudsters. By familiarizing ourselves with these emerging fraud trends, and adapting our own strategies in response, we can view AI technology as an advantage instead of a threat.

Sources:

Workers’ Compensation: The Origin Story

May 31, 2024Author: Liz Maurer

A brief history of Workers’ Compensation

In the insurance industry, workers’ compensation claims can seem difficult to navigate. But the history and evolution of, what we call, workers’ compensation can offer a new perspective on how and why these systems became what they are today. The concept of compensation for bodily injury began thousands of years ago, shortly after the advent of written history itself.

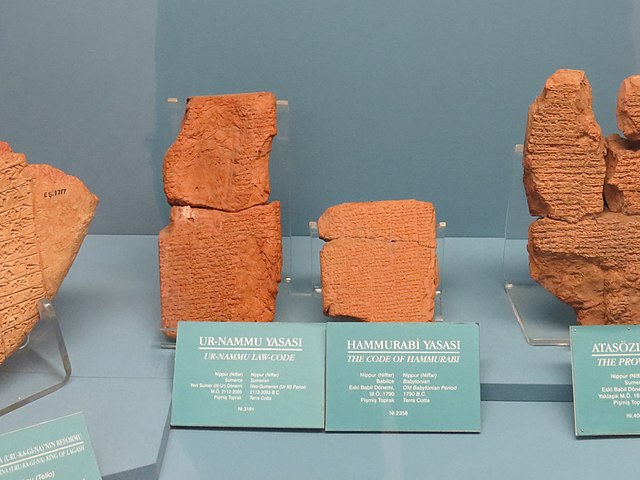

2100-2050 B.C.E. Ur Nammu

King Ur-Nammu, the ruler of the ancient Sumerian city of Ur, created the Code of Ur-Nammu, which was written on tablets and was comprised of 40 paragraphs containing both civil and criminal offenses, along with their punishments. Among other things like defining class rank and outlining the consequences of witchcraft, the Code of Ur-Nammu provided the first legal system in which monetary compensation was paid to injured victims. Much like modern day insurance, the amounts to be paid were based on the anatomic location of the injury as well as the severity.

This compensation system was also to be provided to laborers that were injured while performing their duties, making this the first documented instance of workers’ compensation in history. Heavy machinery and construction equipment didn’t exist in ancient times, so many workers’ injuries were caused directly by other people (and not always accidentally), so it was the offender’s personal responsibility to compensate the victim. The Code of Ur-Nammu became the basis for countless other legal codes and formed the foundation of legal systems still in place today.

The first copy of the Code of Ur-Nammu is currently on display at the Istanbul Archeological Museum.

1795-1750 B.C.E. Hammurabi

King Hammurabi of the Old Babylonian Empire brought us the Code of Hammurabi, famously known for its unforgiving tit-for-tat, or eye for an eye disbursement of justice. The focus was on physically punishing perpetrators rather than just compensating the victim. And while the punishments certainly seem harsh by modern standards, the Code of Hammurabi sought to protect workers from employers whose negligence caused them harm.

The Code of Hammurabi was one of the earliest examples of the concept of presumption of innocence and gave both the accused and the accuser the opportunity to provide evidence. If it could be proven that a worker was injured unintentionally, and not due to their employer’s neglect or carelessness, the employer was only on the hook for the victim’s medical costs, and they could keep all their limbs.

Workers’ Compensation laws continued to evolve in the coming years as ancient Greek, Roman, Arab and Chinese civilizations soon adopted their own sets of compensation schedules. However, all these very early schedules of compensatory rates were either overly specific or vague, leaving way too much room for interpretation in either direction.

The term “eye for an eye” comes from the Code of Hammurabi: “If a man has destroyed the eye of a man of the gentleman class, they shall destroy his eye.”

500s-1400s

These ancient compensation schedules were gradually replaced during the Middle Ages as feudalism became the primary structure of government. It was now up to feudal lords to make the determination about what, if any, injuries garnered compensation. Sometimes this worked in the victim’s favor, as it was an act of nobility and honor for a lord to care for an injured serf, but this was not always the case as not all feudal lords were so noble when nobody was watching.

1400s-1800s

The development of English common law in the late Middle Ages and Renaissance era gave rise to a new legal framework that persisted into the early Industrial Revolution across America and Europe. In response to the increasing number of free citizens entering the workforce doing more labor-intensive jobs, early English Common Law established three principals upon which it would be determined if an injury was compensable. But these principals were known to be so incredibly restrictive, that they became known as the “unholy trinity of defenses.”

- Contributory Negligence- if a worker was in anyway responsible for their injury, the employer would not be held liable, regardless of how hazardous the machinery or equipment may have been

- The “Fellow Servant” rule- employers were exempt from liability if a workers’ injuries arose out of the negligence of a co-worker

- The “Assumption of Risk”- employees are made aware of the potential hazards of any job once they sign their employment contracts, and they accept those risks. Because the risks were so high, these employment contracts became appropriately known as “Death Contracts”

Meanwhile in Prussia, Chancellor Otto Von Bismark established the Employers’ Liability Law of 1871.

The law provided social protection to workers who held high risk positions in factories, quarries, railroads, and mines. Several years later after the unification of Germany, Bismarck also created Workers’ Accident Insurance, the first modern system of workers’ compensation. These state-administered systems reserved large monetary benefits for job-related injuries, and covered both medical care and rehabilitation for injured workers.

Otto Von Bismarck was known for wearing a military uniform anytime he faced the public, even though he never actually served in the military.

The British eventually followed suit in 1893 with the proposal of the Workers Compensation Act, which would abolish the unholy trinity of defenses, including the issuance of “death contracts.” The Act held that an employee was entitled to compensation for any accident that was not their fault, even if there was no negligence on the part of the employer. Unlike the German model, the Act did not rely on the state to administer compensation, but it was instead up to organizations called “friendly societies,” which were mutual financial institutions similar to modern day insurance companies.

1900s- Present Day

The United States was slower to adopt the hot new trend of compensating workers for occupational injuries, giving rise to social movements like the “Muckrakers,” which was a group of authors who wrote about the struggles of working in the modern industrial society. The most famous among these was Upton Sinclair, who published The Jungle in 1906. His novel exposed the horrific conditions in Chicago slaughterhouses from an immigrant workers’ perspective in graphic detail and in no uncertain terms.

Upton Sinclair in 1900

In response to the growing unrest, Congress passed the Federal Employers’ Liability Act of 1908 under President Howard Taft which amended the unholy trinity of defenses to be less restrictive and more in favor of the worker. Keeping in mind this reform came at the federal level, it was still up to individual states to establish their own workers’ compensation guidelines.

In 1910, representatives of the industrial states assembled for a conference in Chicago with the goal of creating a unified set of guidelines for workers’ compensation law.

The first set of comprehensive workers’ compensation laws at the state level was passed in Wisconsin in 1911. Nine other states quickly passed similar legislation, followed by another 36 states before the end of the decade. Mississippi, the final state to pass workers’ compensation laws, finally did so in 1948.

In their original form, most state compensation acts made employer participation optional. But because employers who declined to participate were barred from using those common-law, unholy trinity defenses, the vast majority of employers opted in.

Today, after several thousand years of history in the making, our workers’ compensation systems are fully employer-funded through commercial insurance or through the creation of a self-insurance account, and nearly all states require employers to carry it. We have a much more sophisticated system of classification that has been tailored to fit each and every category of occupation, which allows insurers to provide infinitely more accurate compensatory rates to offer injured workers adequate compensation. The system, by nature, also carries incentives toward rehabilitating injured workers, which benefit both the employer and employee. And that’s why it’s so frustrating when we see people abusing and defrauding these systems that were created as a protection for them. The best thing we can do in our little piece of history is to make sure that these benefits are reserved for those who are genuinely entitled to them by proactively detecting, investigating, and reporting those questionable claims.

Sources:

- Insureon

- Encyclopedia Britannica

- Factinate

- History on the Net

- BBC

- World History Encyclopedia

- Lumen

- History.com

- Code of Ur-Nammu Image attribution: David Berkowitz from New York, NY, USA, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

- Code of Hammurabi Image attribution: John Ross, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

The Legend of “Nub City”

March 15, 2024Author: Olivia Maxwell

Vernon, Florida, Washington County: population 732 as of the 2020 census. A small town named after George Washington’s Virginia home, Mount Vernon. A small town which, from the 1950’s through the 1960’s, was responsible for nearly two-thirds of all the loss-of-limb accident claims in the U.S., earning the legendary nickname, “Nub City.”

Before becoming infamous for a widespread insurance scam, in which its citizens purposely dismembered themselves for large payouts, Vernon was the idyllic small town you’d see in television shows and movies. At least it was, until economic despair struck the people of Vernon.

Steamboats and trains no longer passed through Vernon, and the sawmill, where many residents once worked, closed its doors. Younger generations left for college and never looked back, leaving the town in dire straits. Desperate and down on their luck, the people of Vernon sought new tactics for acquiring cash quickly. In the coming years, nearly 50 citizens of the town would “accidentally” lose a limb in an attempt to receive compensation. These people would later be referred to as the “Nub Club.”

Although the origin of this scam is not known, it is believed that, at some point, a large payout occurred due to a lost limb. Word spread through the small town, and the rest is “mostly undocumented” history.

The trend was first publicly mentioned in an NY Times article written about an investigator, John J. Healy, who reported that “Nub City” was among the worst cases of his career investigating insurance claims (yes, they had investigators, even then). Healy had been hired by Continental National American Insurance group after claims in the Florida panhandle began to exceed $100,000.00. According to Healy, “Vernon’s second-largest occupation was watching hound dogs mating in the town square, its largest was self-mutilation for monetary gain.”

Healy wrote in one report, “Watching anywhere from eight to a dozen cripples walking along the street, gives the place a ghoulish, eerie atmosphere.”

Vernon’s fame persisted when L.W. Burdeshaw, an insurance agent in Chipley, told the St. Petersburg Times that his list of policyholders included a man who sawed off his left hand at work, a man who shot off his foot while protecting chickens, a man who lost his hand while trying to shoot a hawk, a man who somehow lost two limbs in an accident involving a rifle and a tractor, and a man who purchased a policy and then, less than 12 hours later, shot off his foot while aiming at a squirrel.

As more and more of these lost limb claims were filed, the payouts became larger. Some residents even took out ridiculously high insurance policies directly before the “accidents” occurred and provided even more ridiculous justifications for the accidents. Another investigator, Murray Armstrong with Liberty National, claimed that there was one man who took out insurance with 28 or 38 different companies before filing his claim.

Despite the blatantly obvious red flags, it was next to impossible to convict these claimants of fraud. Juries had a hard time believing that anyone would willingly amputate or mutilate their own limbs or appendages. One farmer reportedly walked away with nearly a million dollars from a claim for a lost foot, even though all the evidence pointed to self-amputation.

The scamming finally came to an end in the 1960s when insurance companies wised up and increased their premiums. Some companies even stopped doing business in the Florida Panhandle altogether.

Decades later, documentarian Errol Morris became intrigued by Vernon’s scandalous history. He met with Healy to dig deeper and find out more about this mysterious place Healy had mentioned in the Times article. Healy warned Morris that the people of the town were not fond of outsiders poking around (for obvious reasons), but Morris moved to the area despite Healy’s advice. He began working on a documentary to be titled Nub City. The premise and name of the documentary quickly changed after Morris learned for himself why “Nub City” has become more of a rumor than documented history. Morris knocked on the door of a “Nub Club” double-amputee, whose Marine son-in-law then allegedly physically assaulted Morris for asking questions. That was all the convincing it took to change his documentary’s title to “Vernon, FL” and refocus the film on the interesting characters who still reside in the small town after all these years.

If you find the time to watch the documentary, you’ll see the town has put the gory past far behind them. They are more focused on turkey hunting, wigglers, and growing sand. And while it’s not uncommon for the older residents to be missing a limb or two, they are back to their same old small-town living, acting as if the legend of “Nub City” is in fact just that, a legend.

Sources:

Vernon, FL (1981) by Errol Morris

Vernon, FL image attritibution: Florida Royalbroil, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons

Errol Morris in 2013 image attribition: Ross from hamilton on, Canada, CC BY 2.0 https://creativecommons.org/licenses/by/2.0, via Wikimedia Commons

Famous Faces of Fraud: ‘Basketball Wives: LA’ Reality TV Star, Brittish Williams

November 9, 2023This series focuses on celebrities and public figures who have either been charged with or convicted of insurance fraud in the U.S. Fraud is not a victimless crime and impacts us all. When people, or celebrities, decide to take advantage of or defraud insurance companies, the rest of us pay the price in the form of increased insurance premiums, that we have no choice but to pay if we want insurance coverage. Highlighting these notorious fraudsters will hopefully help to set an example for the rest of the opportunists who think taking advantage of undeserved benefits is worthwhile, the consequences of defrauding the system are real. These are the famous faces of fraud and their stories.

Author: Olivia Maxwell

Reality TV star Brittish Williams made her television debut in 2014 on the third season of VH1’s “Basketball Wives: LA,” a show that revolves around the drama-filled lives of wives, girlfriends, and exes of professional basketball players. At the time of her first appearance, she was engaged to Lorenzo Gordon, who played for the Obras Sanitarias, a Buenos Aires basketball team. Williams and Gordon also starred on a season of “Marriage Bootcamp” together in 2016, following allegations that Gordon had cheated on Williams with a model he met in a hotel. The details surrounding the cheating scandal, and their “on-again-off-again” relationship that followed, continued to make social media headlines until 2020 when their relationship eventually dissolved. And despite having a child together, the two have been estranged ever since. However, not having a professional athlete fiancé has not stopped Ms. Williams from maintaining her celebrity status. Williams later became the host of a morning radio show called, “The Home Team,” has a podcast called, “The Safe Space,” and she has owned multiple businesses over the years.

According to federal prosecutors, Brittish Williams caught investigators’ eyes in 2021 when they had learned that Williams had been lying for years on tax returns and other financial documents. From the year 2016 through 2019, Williams made false statements on her taxes, reporting her businesses’ earnings to be significantly less than what they actually were, and she falsely claimed her niece and nephew as dependents to collect additional money. Around the same time, she also applied for loans, took out lines of credit, and opened bank accounts for her businesses using other people’s social security numbers. She also deposited thousands of dollars’ worth of checks taken from other’s accounts without their knowledge and withdrew the money for herself.

During the pandemic, Williams submitted multiple applications for COVID-19 relief money with false information and was paid roughly $197,000 in government aid. She applied for rent relief programs in the state of California but was already receiving rent reimbursements from the show she was filming at the time.

Additionally, Willliams submitted numerous fake medical bills to her insurance company for reimbursement.

On September 22, 2021, in the midst of her fraudulent activity, Brittish Williams was charged with five felony counts of misuse of a social security number, four charges of bank fraud, three charges of making false statements to the IRS, three charges of wire fraud, and three charges of aggravated identity theft. She was arrested on October 7, 2021, but pled not guilty to all charges at the indictment and was released on bond.

At the time of her indictment, Williams’ lawyer, Jason Korner, told ‘Law & Crime,’ “We do believe that Ms. Williams was targeted in part because of her celebrity. At this point, the government has not produced or turned over any evidence to us, so we can’t speak to specifics, but we believe when we do look at it, it will reveal that she was targeted because of her celebrity, and what she did was lawful.”

The defense’s tune certainly changed shortly after, as Williams continued her fraudulent activity by cashing a check for $27,800 from the California rent relief program at a bank in St. Louis. The charges continued to rack up, and the evidence was indisputable. Before the proceedings, a plea deal was offered to Ms. Williams.

In May of 2023, Brittish Williams pled guilty to a total of 15 felony charges. In the plea agreement, Williams took accountability for three pandemic frauds, once insurance fraud, nine applications that contained false income and payroll information for Economic Injury Disaster Loans, four applications for the Paycheck Protection Program, and one for the California COVID-19 Rent Relief Program.

The plea agreement states she received $144,000 in disaster relief loans, $52,647 in Paycheck Protection Program loans, and $27,801 in rental assistance. She also falsified medical bills for a total of $139,479.92 in insurance fraud.

The sentencing hearing took place on October 24, 2023 in St. Louis, Missouri. In court, Williams expressed remorse for her actions, acknowledging that she made poor decisions, stating, “Opportunities arose, and I made the wrong decisions.” Williams pleaded with the judge for leniency, expressing how “heartbreaking” it would be for her to be apart from her daughter. U.S. District Judge Henry E. Autrey sentenced Williams to four years in prison and ordered her to pay $564,069 in restitution, stating, “You knew what you were doing. You knew it was wrong, and you did it anyway.”

After the sentencing, defense attorney, Beau Brindley, made a statement, “Brittish Williams was punished today, not for fraud, but for her celebrity. The court chose to treat her more harshly due to her status as a public figure rather than treating similarly situated defendants equally. Ms. Williams’ success is not a crime subject to enhanced penalty. And we will challenge this sentence through every legal means available.” Brittish Williams herself has not made any statement.

The DOJ tabulated over $446,000 in losses due to Brittish Williams’ crimes. Her fraudulent activity victimized taxpayers, banks, creditors, insurance companies, individuals, and programs that were intended to help struggling businesses and individuals during the COVID-19 pandemic. Brittish Williams’ combined charges total a potential sentence of up to 55 years in prison, with fines of up to $2,250,000. Considering a jury trial likely would have landed her a much harsher sentence, her four-year plea deal with slightly over half a million dollars in restitution, is certainly not an unfair punishment for her crimes.

Additional Resources:

Don’t Lose Sleep: Sleep Disorders and Workers’ Compensation

October 27, 2023Author: Olivia Maxwell

Sleep disorders are common and often undiagnosed. According to the National Institute of Neurological Disorders and Stroke, approximately 40 million people in the U.S. suffer from long-term sleep disorders, and an additional 20 million people suffer from occasional sleeping problems. The fatigue from these disorders is not only a safety concern within the workplace, but also could become a huge financial burden for employers if working conditions or schedules are found to be a contributing factor to someone’s inability to sleep normally.

What are sleep disorders?

Sleep disorders can be described as a lack of sleep caused by something other than binging Netflix, staying out late at night, or consciously choosing another activity instead of sleeping. Sleep disorders are serious conditions that can cause impairment during the day. There are various types of sleep disorders with different effects on a person’s mental, physical, and emotional well-being.

The most common type of sleep disorder is Insomnia. Insomnia can make it difficult to fall asleep, hard to stay asleep, or cause you to wake up too early and not be able to get back to sleep. Short-term (acute) insomnia lasts for days or weeks, while long-term (chronic) insomnia lasts for a month or more. Insomnia can sometimes be associated with other medical conditions or medications.

Obstructive Sleep Apnea is a sleep disorder that causes a person to stop breathing repeatedly during the night. Many with sleep apnea suffer from other health problems that are exacerbated by their sleep disorder.

Restless Legs Syndrome is a condition that causes an overwhelming urge to move the legs, usually because of an uncontrollable sensation. This condition can often disrupt sleep as it typically happens in the evening or nighttime hours while sitting or lying down. This condition can begin at any age and generally worsens as you age.

Shift Work Disorder, also known as circadian rhythm sleep disorder, largely affects people who work during the night, in the early morning, or rotating shifts. This sleep disorder is characterized by insomnia, excessive sleepiness, or both, and affects people whose work schedules overlap with the typical sleep period.

Sleep is crucial to our overall health. Adults need an average of seven to nine hours of sleep each night, but 30% report averaging less than six hours. Chronic sleep-deprivation can cause depression, obesity, cardiovascular disease, and other illnesses, and is estimated to cost employers $136 billion per year in health-related lost productivity.

Common risk factors for sleep disorders include working second or third shift, obtaining less than seven hours of sleep per night, commuting longer than 30 minutes one-way to work, and having less than 12 hours off between shifts. Because of this, jobs like factory workers, nurses, police officers, firefighters, doctors, medical students, airplane pilots and air traffic controllers, truck drivers, senior management, and network administrators are all at high-risk for sleep disorders.

While an injured worker can pursue a claim for a work injury that results in a sleep disorder, there are limitations as to whether one can claim permanent disability as a result of a sleep disorder. In California, the current law indicates that there shall be no increases in impairment ratings for sleep dysfunction arising out of a compensable physical injury. However, if the sleep disorder is the direct result of an incident that occurs at work, such as a stressful or traumatic event, the employee may be eligible for permanent disability.

These specific laws vary from state to state, but getting treatment for sleep disorders through a workers’ compensation claim is possible as long as the employee can reasonably prove that the sleep disorder was either caused by or worsened by work, which is standard for any work compensable injury.

The determination of whether or not the sleep disorder was caused by or worsened by work is left up to the QME or AME. The medical evaluation will determine the diagnosis and medical causation. Determination of liability of sleep disorders lies solely on the medical evaluation. However, helpful tools such as a medical facility canvass can help the employer or insured determine if there was previous treatment for the sleep disorder, which may be helpful in mitigating claims.

Not only can sleeping disorders become workers’ compensation claims themselves, but they can often lead to other work-related injuries. Research suggests that around 13% of all work injuries could be due to sleep problems. Sleeping disorders can cause difficulties concentrating, decreased hand-eye coordination, slowed thinking/reaction time, reduced attention span, worsened memory, poor/risky decision making, lack of energy, and mood changes, all of which can easily turn into a dangerous situation in the workplace. Highly fatigued workers are 70% more likely to be involved in accidents. In one recent case, a ferry captain suffering from fatigue failed to prevent his ferry from striking a ferry terminal, causing $10.6 million in damages to the boat and piling. Investigators determined that the captain had become briefly incapacitated during a microsleep episode, which caused him to lose control of the vessel.

Regardless of who is held liable for the sleep disorder, it is clearly important that employers and insurers are actively helping to educate and prevent disordered sleeping amongst employees. This will, in turn, help to decrease other work-related injuries altogether.

When possible, employers should avoid rotating shifts, offer ample time off between shifts, ensure a work-life balance is prioritized, and provide flexibility for employees who may be struggling with lack of sleep. Workplace environments can also be modified to increase alertness with lighting, temperature, and noise, and can incorporate dedicated break rooms or even nap rooms. Making these changes may result in higher levels of productivity while lowering safety risks and the potential for workers’ compensation claims down the line.

Providing employees with the information and tools to understand and improve their sleep is a great place to start. Encourage employees to establish a regular bedtime routine, avoid caffeinated drinks such as soda, tea, and coffee before bed, minimize stress, and exercise regularly to ensure a good night’s rest.

Know the signs and symptoms of when someone should seek treatment for a sleep disorder, and where they can go for help. For more information, visit the CDC’s website below:

Sleep: An Important Health and Safety Concern at Work (cdc.gov)

Additional sources:

High Stakes in Workers’ Compensation

July 28, 2023How the legalization of marijuana is affecting the Workers’ Compensation industry

Author: Olivia Maxwell

Over the last few decades, the topic of marijuana legalization has been a tough one to avoid. It started in 1996 when California became the first state to legalize medical cannabis, with many states following, and now with some states even legalizing marijuana for adults’ non-medical use. The movement in favor of legalizing medical cannabis usage only continues to gain momentum, but its potential impact on the workplace have left many legislators, insurers, and employers feeling dazed and confused.

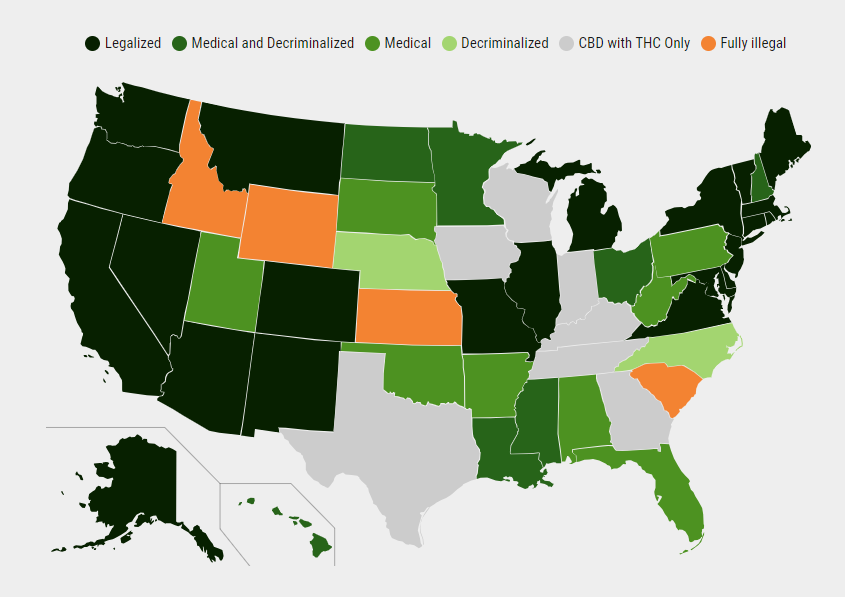

As of 2023, 38 US states, three territories, and the District of Columbia have legalized the medical use of cannabis products. There are also two US territories and 24 states including the District of Columbia that allow adult non-medical use of cannabis. Additionally, there are approved measures in 9 states allowing the use of “low THC, high cannabidiol (CBD)” products for medical reasons in limited situations. For additional details on the status of legalization of marijuana in the U.S., click here.

While some states have legalized its use, it remains illegal at the federal level. However, the states are able to circumvent this because of recent laws that prohibit the federal government’s interference with individual states’ medical cannabis laws, the legalization of low-THC hemp and hemp products, and cannabis research for medical purposes. The evolution of marijuana’s legalization is ongoing, but without federal regulation, there are many gaps in the knowledge guiding employers’ workplace policies surrounding its usage.

As the laws adapt, employers must adapt, too. Important considerations for employers when revising company policies regarding marijuana usage include employer liability, employee safety, and laws that prohibit unfair discrimination. On one hand, federal laws protect employers who choose to completely prohibit employees from partaking in recreational marijuana, whether legal or illegal in their state. However, this could be considered discriminatory if an employee is using marijuana for medical reasons with a proper prescription, and their use does not pose a potential safety concern for other employees. It is best to consult with a lawyer when implementing specific policies in the workplace to ensure the policies are not discriminatory. Keep in mind that many employers consider their employees “at will” and reserve the right to terminate for any reason, so users beware.

There are several steps that employers and insureds can take to ensure that company policies are up-to-date with current research and regulations regarding employee marijuana usage. First, it is recommended to revise any existing company guidelines surrounding substance use to include terminology such as, “subject to change,” or “individual circumstances permitted upon review.” Having a lawyer review these policies before implementation is always best practice. Next, understanding the differences between impairment testing versus drug testing, and when to use each, will help determine the best response to incidents, accidents, and injuries in the workplace. Drug testing can measure the presence of drugs or their metabolites in a person’s body at the time of an incident. However, because some drugs, including marijuana, can remain in a person’s system from anywhere from days to weeks, an employee can test positive for drugs without showing signs of impairment. Therefore, impairment testing can assess a person’s current state of intoxication, and establish whether the employee is actually impaired at the time of the incident. See more details about drug testing versus impairment testing here.

Another factor for employers to consider is whether workers’ compensation benefits will cover the cost of medical marijuana, should it be prescribed to alleviate pain from an injury. The pain management offered by the use of medical marijuana may allow employees to return to work sooner, but the risks associated with an employee potentially being impaired while on the clock could create safety and liability concerns. However, it is important to note that many studies have shown that medical marijuana is a much lower-risk solution for pain mitigation than opioids, and is less likely to result in addiction which could actually prolong the return-to-work process. Further research, including more comprehensive and long-term studies, are still needed to better understand the relationship between medical marijuana use and workplace safety.

While research is still ongoing and laws are changing, employers must take a proactive approach to mitigating workers’ compensation claims that involve the use of legalized marijuana. Reviewing employees’ backgrounds for any history of drug or drug-related charges, canvassing medical treatment facilities and rehabilitation programs, and surveilling claimants to document any evidence of substance use before entering the workplace may be helpful resources that a private investigation agency can provide. Of course, employers should do all they can to prepare for these claims before they happen, and to obtain impairment testing at the time of the incident, but a thorough investigation can act as a safeguard to ensure all bases are covered in the event of any legal challenges.

The topic of marijuana in the workplace is certainly a multi-faceted subject with many points for employers and insurers to review and consider. It is best to stay on top of incoming research and continue to adapt and re-review policies frequently for the best possible outcomes. The CDC and The National Institute for Occupational Safety and Health (NIOSH) are trusted organizations to follow regarding workplace safety and the use of marijuana as it continues to evolve. But know that in the ever-changing world of insurance and workers’ compensation, there are always trusted private investigators staying educated and adapting to the claims world in order to better assist in all of your claims’ investigations.

Sources:

State Medical Cannabis Laws (ncsl.org)

Cannabis and Work: Implications, Impairment, and the Need for Further Research | Blogs | CDC

Famous Faces of Fraud: Prominent South Carolina Prosecutor, Alex Murdaugh

February 6, 2023This series focuses on celebrities and public figures who have either been charged with or convicted of insurance fraud in the U.S. Fraud is not a victimless crime and impacts us all. When people, or celebrities, decide to take advantage of or defraud insurance companies, the rest of us pay the price in the form of increased insurance premiums, that we have no choice but to pay if we want insurance coverage. Highlighting these notorious fraudsters will hopefully help to set an example for the rest of the opportunists who think taking advantage of undeserved benefits is worthwhile, the consequences of defrauding the system are real. These are the famous faces of fraud and their stories.

Author: Olivia Maxwell

You may have seen the name, Alex Murdaugh, recently in the news, as he is currently on trial for the murder of his wife and son. What you may not be aware of is that Alex Murdaugh is also pending trial for a total of 80 criminal charges through 16 state grand jury indictments for schemes to defraud a slew of victims for a total sum of nearly $8.5 million. The charges for insurance fraud, conspiracy to commit insurance fraud, and filing a false police report, in relation to Murdaugh’s September 4th attempted suicide-for-hire plot, qualifies Alex Murdaugh for our Famous Faces of Fraud series.

Alex Murdaugh comes from a prominent American legal family in South Carolina, where he was one of three family members to consecutively serve as solicitor, in charge of prosecuting all criminal cases in the state’s 14th circuit district. Murdaugh’s family also founded a nationally recognized civil litigation law firm in Hampton, South Carolina that specializes in personal injury litigation. As a well-recognized and well-respected attorney in South Carolina, Alex Murdaugh and his family are no strangers to the public eye. However, this family has made national headlines for all the wrong reasons over the past few years.

A simple google search reveals connections that have been made during Alex Murdaugh’s insurance fraud investigation to multiple cases, involving both fraud and murder.

Stephen Smith -A 2015 cold case, the murder of Stephen Smith, was reopened after discovering information relevant to the case while investigating Alex Murdaugh for insurance fraud. The oldest Murdaugh son, Buster, was the same age as Stephen Smith and they went to school together. It is presumed the two would have known one another. Initial investigations had several mentions of the Murdaugh name before the case went cold after being classified as a hit and run.

Gloria Satterfield – The Murdaugh family housekeeper died in 2018 after sustaining injuries falling down steps at Murdaugh’s home, her heirs were granted $4.3 million in a wrongful death settlement paid out by Murdaugh’s insurance, which Murdaugh then embezzled and has since confessed to. The investigation into this fraud scheme revealed that an autopsy had never been performed on the housekeeper’s body. In June of 2022, the body was scheduled to be exhumed for an autopsy to be performed. Investigations into the death of Gloria Satterfield are still ongoing.

Mallory Beach – Alex Murdaugh’s now deceased son, Paul, allegedly drove his family’s boat into a bridge piling while drunk in 2019. Several passengers went overboard including Mallory Beach, who never made it out of the water that night. Her body was found 8 days later. Paul was pending trial for charges related to the incident, and Mallory’s family had filed a wrongful death suit against the family.

This was when investigators initially began digging into Alex Murdaugh’s finances, just before the death of his son, Paul, and wife, Maggie.

On June 7, 2021, Alex Murdaugh found Paul and Maggie dead.

On September 3, 2021, while the investigation into the murders of his son and wife were still ongoing, Alex Murdaugh was accused of stealing money from his law firm and clients. The next day, September 4, 2021, Alex Murdaugh was shot by Curtis Edward Smith, a former client. Allegedly, Murdaugh had hired Curtis to kill him, so that his only surviving son, Buster, could collect the $10 million life insurance payout for his death. However, Murdaugh’s plan failed when he survived the gunshot. He was airlifted to the hospital and 2 days later, September 6, 2021, announced that he would be admitting himself to rehab for treatment of his opioid addiction. Murdaugh also announced his resignation from his law firm at that time.

On September 16th, 2021, Alex Murdaugh was arrested and charged with insurance fraud, conspiracy to commit insurance fraud, and filing a false police report. He was booked and released back to rehab on $20,000 bond. In October the official investigation into the Murdaugh’s family finances took place and Murdaugh was arrested again, while in treatment for addiction, on new charges alleging additional fraud. As investigations went on, Murdaugh continued to accrue additional charges for several different fraud schemes discovered during this time.

While pending trial for his many other charges, on July 14, 2022, a jury indicted Murdaugh on two counts of murder and two counts of possession of a weapon during the commission of a violent crime in connection to the deaths of his wife, Maggie, and son, Paul.

Alex Murdaugh’s murder trial began on Wednesday, January 25, 2023 and concluded on March 2, 2023 with guilty verdicts on all counts. Murdaugh was sentenced to life in prison and despite that life sentence, he still must face the charges for embezzlement, computer crimes, money laundering, conspiracy, and insurance fraud in court.

Alex Murdaugh’s trial took place at the Colleton County Courthouse in Walterboro, South Carolina.

We will continue to post updates on Murdaugh’s trials and convictions as they occur, but to face ALL of his charges will likely take quite some time. Check back for updates on the Famous Faces of Fraud.

Image attribution: Upstateherd, CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0, via Wikimedia Commons